richmond realtor

Keep on top with latest and exclusive updates from our blog on the Los Angeles real estate world. Cindy Bennett Real Estate posts about tips and trends for buyers, sellers, and investors every week. Whether it be about staging your property or a snapshot of the market, this is your one stop shop.

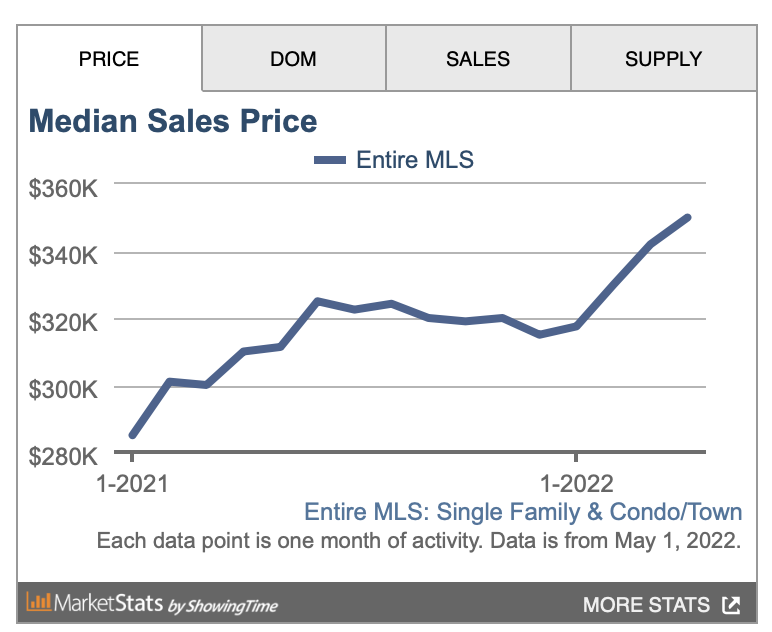

So, how did the market look in April? Well, the news may be saying there is a national slow down, but it doesn't seem to have reached us quite yet. Here's the breakdown by the numbers. Average Sales Price in the month of April was $412,850. That's up by 13.2% from last April, and it's still trending upward. (Yes, that means good news for sellers, but buyers in most price ranges are still engaging in bidding wars on most properties.) New Listings were actually down in April, by 25.3%,. but part of that can easily be accounted for by Easter/Passover holidays and spring breaks. Most people don't list during spring break weeks, so that is always to be expected. Closed Sales where also down (likely in part, at least, for the same reason) by just over 12% from last year. Average Days on Market seems to just keep going down! The average in April was 14 days, but keep in mind, that is indeed the average. Much higher than the median, which is only 6. Frankly, 6 is a high number, as most listings go on for 4-5 days, with a deadline for reviewing offers, so if they had no deadline, that number would certainly be lower. The average percentage of list price to sales price is up by just over 3% from last year, clocking in at 107.4% for the month of April. What does all of this mean? Well, at the risk of repeating the same refrain you hear all the time, it really is a great time to be a seller. That still means you have to price your home well, and do all the things to show it off in the best light. BUT, if you follow that course, there is a strong likelihood that you will indeed get multiple offers, with contingencies waived and more money than the listing price. If you're buying, well...things are tough out there, I'm not going to lie. But, having a plan, a preapproval, and most of all, a strategy, can get you in a great home to be enjoying by the time summer is truly here. With rates ticking up, we are likely to see a bit less competition in some higher price ranges, and many people are adjusting their price ranges and budgets to account for the increase. If you are thinking of buying or selling, or just wondering if it's the right time for you, reach out. I'd love to help.

Read more

Rates have gone up. The market is crazy. Everything's a multiple offer situation. There are so many competitive bids out there. Is it even worth trying to buy a house? There are lots of reasons like that, that I hear people say every day and I'm here to tell you that especially if you're renting, you may not want to wait until the market crashes or wait until things cooled down. Yes, rates have ticked up just a little bit, but they are still historically low. Also, if you think about the fact that a $300,000 home with 5% down, your mortgage payment is going to be somewhere around just under $1,800. If you put 5% down, your rent may be $1600, $1700, $1,800 right now. Think about it this way. That year that you're waiting for that market to cool off, you will be spending $1,600 a month paying the equity in your landlord's mortgage. Wouldn't you rather be building the equity towards your own future, paying off your own home than paying somebody else's? Also, just like home prices are going up, rental prices are going up at the same time. So, don't wait so long that you get stuck in a cycle of having to continue to pay rent while the prices continue to go up just because you're waiting for some imaginary crash. Don't wait for it. It's probably not going to happen for a really long time. If you're thinking about buying a house or just dreaming about buying a house, give me a call. Send me a message. Ask me a question. I'm happy to talk to you and I'd love to walk through whether or not it is really a good time for you to buy.

Read more

If you’ve been thinking about buying your first home, chances are you’re getting tons of advice from everyone you've mentioned it to. It can be pretty overwhelming, and that's why I want to share 3 home buying myths you need to know if you’re considering homeownership. These will help debunk some of the things you may be hearing from people who probably have great intentions, but probably aren’t professionals. MYTH #1: You Have to Put 20% Down to Purchase a Home This could be the biggest home buying myth of all time! Putting a minimum of 20% down on a house does have some financial benefits .. BUT it isn’t required. There are several options when it comes to financing your home so you’ll want to meet with a local lender to discuss these options before jumping head first into the process. There are loans that require as little as 3% down as well as resources for buyers struggling with down payment money and first time home buyer programs. MYTH #1 Tip: Do not get pre-approved from an online lender. Find someone local who you can actually sit down with, understand your options and make the best decision for your financial future. (I can refer you to some great ones.) MYTH #2: It Doesn’t Matter if I Don’t Have a Real Estate Agent Some buyers prefer not to commit to working with one specific agent. That means they don’t take advantage of hiring a buyer’s agent to help them with their home purchase. That means they’re on their own for scheduling showings, being alerted of new listings, and when it comes time to negotiations, they won’t have anyone working in their best interest. This is not a great combination- especially in this market. It can prevent you from getting an accepted offer on the house you really love because you haven’t been educated on the market or how quickly you need to make a move. Right now, that's QUICK! It could also result in you losing money or overspending because you don’t have anyone negotiating on your behalf. I don’t know about you, but if I’m buying my first home, or any home, for that matter, that does not sound like a great situation. MYTH #3:Prices probably won't keep rising forever. But a market crash isn't likely, based on who's buying homes now: people with low debt-to-income ratios who put a lot of money down after losing out on a few homes to other buyers. "They will not be the first to abandon their homes if there is a downturn in the economy," said Kenneth ErI of Climb Real Estate. "These homes are owner-occupied and not highly leveraged like in the run-up to the last crash." There are certainly a few more myths, but I'm here to help you navigate them. If you think you're ready to purchaase, give me a call, or email me here. I'd love to help!

Read more