richmond realtor

Keep on top with latest and exclusive updates from our blog on the Los Angeles real estate world. Cindy Bennett Real Estate posts about tips and trends for buyers, sellers, and investors every week. Whether it be about staging your property or a snapshot of the market, this is your one stop shop.

Here are a couple of reasons why you may not want to buy a house in 2023 or 2024. The market that we're in is a little weird. And with rates a little higher property values a little higher, and things a little bit tighter in regard to inventory. It is definitely a little harder to get into homeownership now, if you are not already in the game, so to speak. So, the first reason that you may not want to buy a home in 2023, with the higher values and the higher interest rates is, if you are thinking you are not going to be in the home for at least two to five years. You probably want to wait and hold off on buying for a little while, given the interest rate and the cost of homes right now. And all of the fees and costs associated with buying a home your closing costs, etc. You may well not recoup the money that you put in, in that two year period, enough to make any sort of gain when you go to sell, if it is in two years or less. I am almost always going to say that time in the market is better than timing the market. So I talked to a lot of potential buyers, a lot of first-time buyers who are waiting for interest rates to drop. They're hoping that interest rates are going to drop and prices are going to drop. Those things very seldom happen at the same time. My advice to them is if you buy now, at a higher interest rate, you can always refinance later, but odds are if you wait to buy, those prices are going to be higher. So while rates may come down, prices will still continue to go up, because we're still in an inventory shortage. So buying now is going to give you more time in the market for that property to appreciate and your interest rate can always go down. I say that with the caveat that you don't want to buy a house on the market right now if you cannot afford the payment. Please, please, please do not spend every dime of your savings on the down payment for a house and put yourself in a position where you're not able to go out to eat, take a vacation, buy furniture, come up with the money for unexpected expenses like your car breaks down or somebody needs a medical procedure. Things like that are not worth getting in the market if you're not quite ready. So even if you're ready, even if you're thinking about buying a home, talk to an agent that you trust and talk to a mortgage lender to get a good idea of what your payments are going to be what your costs are going to be. And it's okay to wait if you're not ready. Just don't wait too long, or wait too long thinking that that dream home that you can't afford now is going to be affordable in two years unless you know that you're going to get a significant bump in pay. But if you have any questions about buying, I'd love to talk to you. I'd love to help you decide if now is the right time and what might be a reasonable way to get your foot in the door right now. So that dream home may be two years away but you've started the process now give me a call or send me a message I'd love to talk to you.

Read more

Have you always thought about buying investment property, but you're not sure where to start, how to start, or what you need to know to really get going? And who would do that in this market anyway? Let's unpack some of the numbers and historical numbers and kind of take a look at why now might actually not be a bad time to get into real estate investing. If you look at the average appreciation over the last couple of years, and these are big national numbers, so they're gonna be dependent upon where you are, and the neighborhood and the area and the county and the city and all that good stuff. But the overall numbers are 20% appreciation on home values over the last two years. Those are pretty wild and crazy numbers, because where are you getting a 20% return on an investment that is relatively safe, like it's not likely to drop by, you know, 100 points tomorrow. Now, those numbers are unlikely to continue. So while 20% is great, that also implies that prices are going to go up by that much, right? Nobody really wants that. But over the last 10 years, we've seen increases in value of about 10%, prior to the last couple of years. So that is still a pretty solid return on your investment over time. When we look at the average return on standard traditional investment stocks and 401k's and things like that, as being between 5% and 8%, take into account the fact that income has only increased year over year by four to 5%. And hedging against inflation. Figuring out how to make your money make more money for you, real estate investing is a really solid way to go. You could check my other video that has some more information about different business models on real estate investing, whether you are looking to have immediate cash flow, whether you just want to balance it and bank on the appreciation, house hack, or any other type of real estate investing. But overall, the appreciation and the ROI that you get from real estate is a really solid investment and something that is a great way to pay for your kids college. If you buy a house when they're young, sell it when they go to school often you can pay for their whole college experience just by the appreciation alone. So if you've ever thought about investing in real estate, it is not a bad time even though rates are a little high. And your return on your investment can be really fantastic depending on what you buy. So if you want more information and you're curious about getting started, you want to see what it takes. Give me a call or send me an email let's schedule a time to chat and discuss your long-term plans, and short-term plans, and see if jumping into the real estate market as an investment is the right time for you.

Read more

So you're thinking about buying some investment property, what are some things you might want to consider? First of all, you want to keep in mind that the parameters that you use for buying investment property are seldom the same as what you would use if you're buying a house that you're going to live in or even a vacation home. There are a few different business models that you can use. And we're talking mainly about residential investment property. So you can do short-term rental, you can do long-term rentals, you can do mid-term rentals. But also, look at how you want to build that portfolio or even just get started if this is your first one. So one of the most ideal business models is something where you're going to have immediate cash flow, but particularly in this market, that is often kind of hard to come by to find something where your mortgage is going to be less than the amount that you're charging for rent. So that is kind of a delicate balance, and something that requires some calculation, and sharpening the pencil to get to the numbers where they need to be. The second business model is where it covers itself pays for itself all along to a degree at least, but appreciates over time. So you're really banking on that appreciation over time. So that would be a scenario where your mortgage is $2,000 a month, and you can also get $2,000 a month in rent. So you do not have to necessarily lay money out every month except for repairs or upgrades and things like that. But it's not making money every month. Nothing is going back in your pocket until you go to sell or it appreciates over time. The third and one you see a lot of investment people and motivational people talk about is "house hacking". And what does that mean? If you don't know house hacking is where you buy a multifamily property. So a duplex or a triplex for a quad and you live in one unit and rent out the rest. This is a fantastic scenario, especially if you're a first-time buyer, if you are not tied up on your first home, particularly your dream home. Or if you just want to focus more on building wealth and building that investment portfolio. So often, it'll pay for you to live there. If your mortgage is $3,000 a month on a duplex, for example, and you can charge $2,000 a month, then you're only paying $1,000 to live in the other unit. You can do this every two years really, and keep swapping up just building your portfolio rather than renting that unit that you've moved out of doing it again and doing it again. So often you'll hear people talk about House hacking. That's what that is. So if you want to get started in real estate investing, one of the best things is, obviously, to give me a call, call an agent in your market who is familiar with investors and working with investors and real estate investing so that you can sort of get the lay of the land and figure out what business model works best for you for your finances, for your family for your future, how you want to do it, because then you can really focus on the properties that are going to work to fit into that business model. But if you're curious about investing, I do have a lot of experience working with investors. I have done this myself. So I know a lot about the process of getting there and going through and some of the pitfalls that you might want to avoid. So give me a call send me a message shoot me an email and let's talk.

Read more

If you're buying a home and you write your offer you love the house, the thing that you love the most is that fantastic chandelier in the dining room, and the adorable dog house that looks exactly like the house you're buying. Make sure you write those things in. Here in central Virginia, our contract actually lists out the items that are automatically assumed to be staying when you buy your house. So they're automatically in the contract. We don't need to write those in. They are technically things that are attached to the house, which means fixtures, fans, curtain rods, blinds, dishwashers, microwaves, and stoves. That's basically it. Now, some of the gray areas can be mirrors in the bathroom, sometimes they are attached. And sometimes they're not refrigerators. Well, they're always attached the same way a stove is, why are they not included? I don't really know. But they're not. So we always write those in. If we're buying a home, and you want to keep that refrigerator or the washer and dryer, we're gonna have to write those in because they're not automatically included in the contract. But I would go a step further and say, that if you absolutely fell in love with that chandelier in the dining room, and the seller wants to take it, they should have excluded it. But if we know we want to keep it and we know we don't want any hurt feelings, or kerfuffle, as we go through the process, we go ahead and write that in as well. So to be safe, we're always going to write in all of those little extras, but probably not the window blinds in the bathroom, and probably not the ceiling fan that's in the rec room. If you're looking at homes online, and you are not working with a realtor, I'd love to help you figure out exactly what you're looking for and what's going to stay with that home when you purchase it. So give me a call and let's chat and I can help you navigate that entire process.

Read more

If you spend any time at all on social media, you probably hear people talking a lot about buying houses to invest in short-term rentals and what a great source of passive income that is. So you maybe thought, Should I buy a house and use it as a short-term rental? Let's talk about some of the details that you might want to think about. You may have heard the old saying, you know, you make money on the front end, not the back end. So if you're looking at a house, to be a short-term rental, make sure that it's not something that's going to need a ton of work that's gonna then price you out of that short-term rental market to recoup your money. Also, make sure that if you are looking in an area that maybe you're not as familiar with, you are familiar with, or get familiar, with the zoning laws and regulations or short-term rentals in that area. Because they don't allow it and you definitely don't want to buy something to use as a short-term rental, and only to find that you can't. If the property is not currently furnished, or if you don't like the furnishings, then make sure that you're calculating into your budget, all those furnishings that you're going to have to put in to make it be fantastic. Because, you can get a great rate for a short-term rental, but not if it looks like everything came from you know, the goodwill. When you're doing your calculations, you also want to include things like who's going to manage it, who's going to check on it? What are the fees going to be? How is it going to get cleaned? Do you have an HOA in that neighborhood or area that needs to be paid? All of those little things get an idea of the utility costs, that sort of thing, and I have a great spreadsheet that you can plug all those numbers in. So if you want a copy of that or you want to get a little bit more information about buying a short-term rental owning a short-term rental, what to look for, and the do's and don'ts. I'd love to talk to you happy to help and put you on the right track to finding out all of the information that you might need to know to make a decision if it is in fact a good call or if maybe you want to go another direction for your investment.

Read more

Should you even really buy a house in 2023? The market seems like it's totally crazy and interest rates are bananas. Even in this high-interest rate environment, there are some really good reasons why buying a home still may be a better option than renting. Probably the biggest one is that owning a home really is kind of an inflation buster. So what does that mean? Well, if you notice, if you rent or you're looking at rentals, you probably see that rentals continuously go up almost every year, rents are going up in almost every area. So if you're renting, you are hoping that you're going to continue making more to get maybe a nicer place a bigger place, whatever, or to just stay in the place you are, that's going to continually get more expensive. When you buy even with interest rates being a little higher, you are locking in that payment for usually a 30-year term, a 15-year, 20-year, or 30-year term, you kind of can't beat that if your payment is say $2,000. Today, it's still going to be $2,000 in 20 years. Whereas if you rent something that maybe costs $1,500 today if you stayed in that same place, I couldn't even begin to tell you what you're going to be paying in 15 or 20 years. Now, that's not to say that there aren't some extra expenses and things that come along with owning a home. So over time, you do gain appreciation, which is a really great investment when you're living there anyway because you're always going to pay to live somewhere. And the benefit of sort of stockpiling that money for yourself rather than paying someone else's mortgage, as you often hear it referred to in a rental. There's a value in there not just monetary, but a pride of ownership. Additionally, sometimes your landlord may not be really keen on you painting the kitchen cabinets, a mural in the kid's rooms, making some renovations to the bathroom, that sort of thing. And when you own your home, you really can customize it to just what you want it to be. There are also tax benefits that come with owning a home as opposed to renting. But always consult a tax professional when you're thinking or talking about any sort of tax-related things because I am not one. And remember, even though interest rates are higher right now if you can afford the payment right now, you are pretty, I'm not going to say guaranteed but almost guaranteed, that at some point rates will tick down and your payment is likely to become less rather than more (if you refinance). Whereas with renting it is 100% guaranteed to go up over time. So if you're thinking maybe I would be interested in buying a home, I'd love to talk to you and help you walk through all of the steps. Look at all the information and see if it is the right choice for you right now. Or maybe it's something you want to do in the next six months to a year. I'd love to talk to you give me a call. Reach out via email and let's set up a time to chat to see if it is the right decision for you.

Read more

So great, waving an inspection is a great way to get your contract at the top of the heap in a multiple-offer situation, but should YOU do it? I am going to tell you that if you don't have some sort of risk tolerance, don't do it. But if you do have a little bit of risk tolerance, there are ways to get around it. So you can pay an inspector a couple of hundred dollars to walk through the property with you and give you a general idea of how those systems, that you may not know how to assess, what kind of condition they're in. But at the end of the day, you are 100% going to have something happen, whether you have an inspection or not. I call these oh s**t moments, it might be six weeks, it might be six days, it might be a year. You can also buy a home warranty, the seller can buy a home warranty for you, or you can buy one yourself, but they're not going to cover everything. So you're still going to need a buffer. It is always a bit of a risk when you have a home that things might go wrong. So if you are on a razor-thin margin, a razor-thin budget, and you can only afford your mortgage payment, that may not be the house you want to buy anyway, inspection or not. But ultimately, your options are probably to pay way more than the asking price and ask for that inspection, giving the seller some sort of security, that they're going to have still a higher offer, even if they end up with items that they have to repair. Or you're gonna still probably pay more than you want in this market and waive the inspection. It's kind of up to you and where your risk tolerance is. But remember, at the end of the day, if everything is equal, that seller is always going to pick the offer that is the least risk for them. So the more risk you can take on the better price you are going to get on the house that you're purchasing. If you want to take a look at more ways to build an offer, write an offer, or buy a home in general, check out some of my other YouTube videos. Or better yet, give me a call. I'd love to talk to you and I'd love to help you find your dream home.

Read more

If you are under contract, and on your way to closing, you're super excited, you've started packing, and you started envisioning how you're going to design your space, here are a few things that you don't want to do if you actually want to close on your house and close on time. First of all, don't buy a car. Please, for the love of all that is holy, don't buy a car. If your car dies, and I have had clients for whom this happened, they have had to bite the bullet and buy a car in between contract and closing. But call the lender, let them know the situation, let them know what's happening, and ask them what to do before you go off half-cocked and do it. Because that can really impact your debt-to-income ratio and that can throw your loan way off track. Second, don't drag your feet on getting information to your lender. They do not want to ask you for a thousand documents and have to keep up with all of those things any more than you want to provide them. But they will not ask you for something they don't need. And as frustrating as it is. And as much as you want to yell at, you know, Marjorie that called you yesterday. And now she wants three more documents. It is not her. So don't yell at her. Just give them the documents they need because there is a process that they have to follow. And their systems going to tell them, oh, now we need this. And yes, sometimes that's the last minute. Third, don't quit your job, even if you get a fantastic job offer. Try to wait out the old job until closing and then take the new job. Yes, you can get a loan if you've been in the same career, same field for the last couple of years. So it may be fine, but it also may not. The best rule of thumb is to try to keep everything the same as it was when you made a loan application. And keep it that way until closing. If you have any more questions about the financial process or what it takes to get a loan and get into a home, I have some terrific lender partners that I'd love to put you in touch with and they would be happy to help you with that side of things. If you have general questions about buying or what it takes to go from contemplating a purchase to contract to close. Give me a call. I'd love to answer any questions you might have. And obviously, I'd love to help you get into the home that you want to be in.

Read more

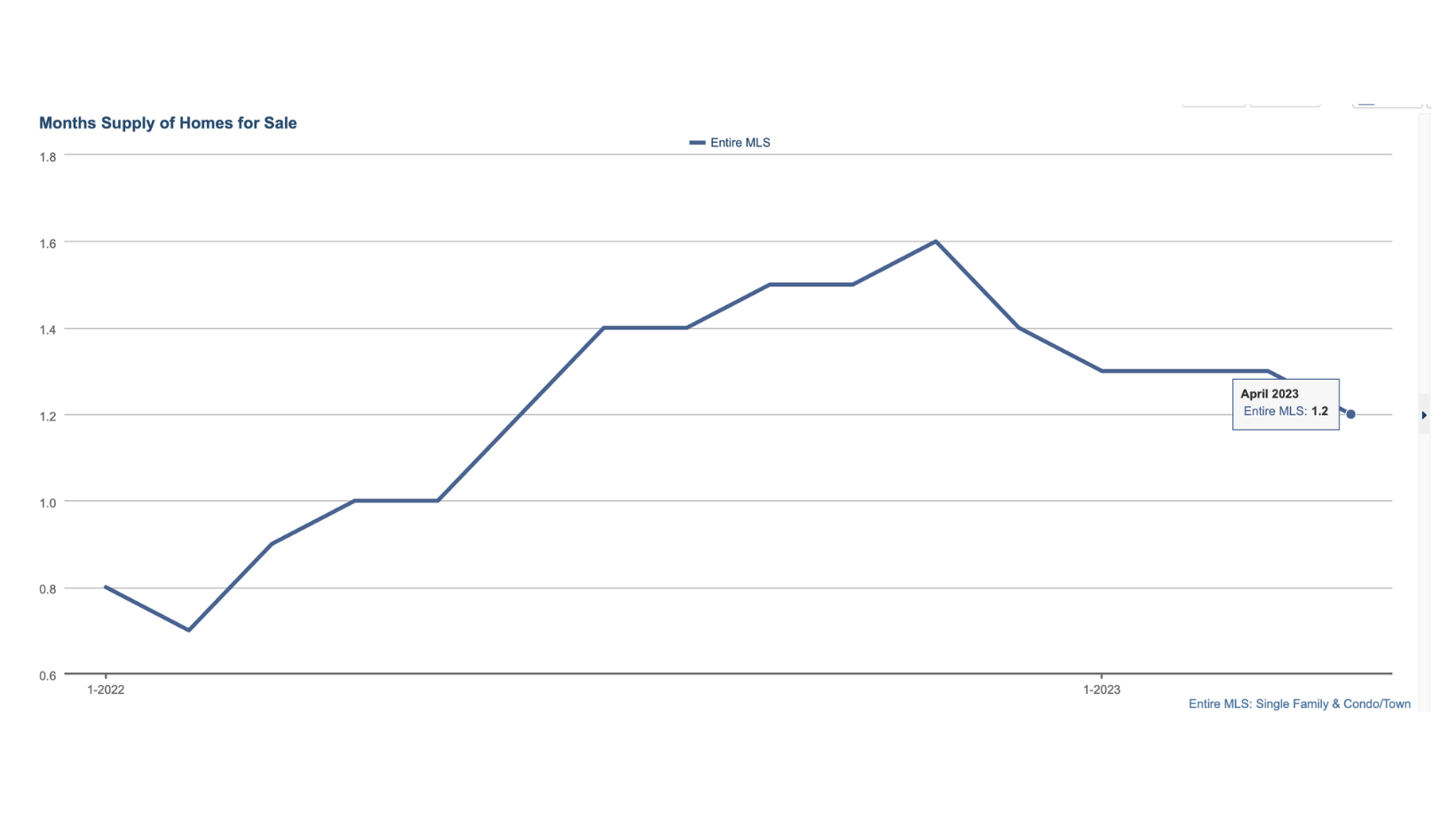

Well, spring is in full swing now, and April showers may have brought flowers, but they certainly didn't bring lots of real estate inventory. Things are still moving quickly, so here's a bit of a recap: The average sales price for our entire MLS area was $402,414 in April. That's up from $403,244 last April, and a good jump from March of this year at $386,797. The price stability and increases really are largely due to the lack of supply in the market. Rates have certainly risen since last year, but for the most part, it hasn't pushed many people out of the market. Our inventory as April closed out stood at 1933 homes for sale, down from 2203 in March, and down from 2022 in April of last year. Supply is just not where we need it to be (frankly, in either rentals or sales) and the demand is definitely out there. As I've said before, the market is considered to be balanced at 6 months supply of inventory, and while we're definitely better than we have been (February '22 had us as low as .7 month), we are still only at 1.2 months. That means that if no other homes came on the market, it would take 1.2 months for the supply to be exhausted. That's not much. What does this all mean for you if you're looking to sell? What about buying? Is it just a crazy time to do that?? These questions are both so unique to your own situation, I always hesitate saying, "it's a great/bad time to sell/buy," to a degree, regardless of the market. What I can say, though, is that if you've been contemplating selling and you thought the market was going to drop as rates went up, that hasn't proven to be true. In most areas, we are still very decidedly in a seller's market, so no doubt that it's a good time to sell. If you're thinking of buying, and it's a great time for you otherwise- new job, lease is up, new baby, new job...whatever, it's not a terrible time to buy- prices do not have the same upward pressure that they had a year ago. Yes, we're seeing multiple offer scenarios, but not every house, not every time, and often not as insane as the offers were last spring. We are seeing more inspections, more appraisals, and a bit more negotiations on some homes. But, it's not the time to drag your feet if you're looking. It's a good time to really know what your negotiables and must haves are, and work with an agent with a solid grasp on the market (like me) that will tell you what they think will get the home you want, rather than just guessing. Keep in mind, too, that there is no perfect market. If rates are lower, prices will be higher, and vice versa. It's nearly impossible to time the market, too. So if it's a good time FOR YOU, it's probably a good time. If you have questions about buying or selling in this market, reach out. I'd love to talk to you and help you determine if it's a great time for YOU.

Read more

Richmond is pretty great in most seasons, but festival season? That's really where we shine! There's little the River City loves more than the combo of outdoors+live music+friends+food trucks+celebration, and of course, adult beverages. Here are a few of my favorites, kicking off in March! March 5-12- Richmond Black Restaurant Experience. Less of a festival, and more of a weeklong celebration of our black owned restaurants. I'm a foodie, so this one definitely counts! March 11- Shamrock the Block moves to Leigh Street this year! Shamrock The Block is a FREE street festival in its 17th year and the kickoff to festival season! March 25-26- Church Hill Irish Festival. This one has the best to offer the 21+ crowd as well as the younger set. It's a party for everyone, and a great way to get a taste of Ireland in RVA. March 30-April 2- French Film Festival. Widely recognized as the best French Film Festival in the country, this event is held at the Byrd Theatre in Carytown, and is in its 29th year this year. A great way to pick up a little culture for a weekend. April 22- Ukrop's Monument Avenue 10k. Touted as "Richmond's Biggest Block Party," that's a pretty accurate assessment. You can run. You can walk. You can do a bit of both. or you can just come down to cheer and party. Whatever you do, it's F U N for all ages. April 29- Herbs Galore & More at Maymont. Great plants- far beyond herbs, live music, food trucks, and more! This is a great way to learn while enjoying a day out, AND getting some great new plants for home. May 6-7- Arts in the Park. Surely one of the best things Richmond is known for is our passion for the arts, and all of the wonderful artists that call RVA home. Arts in the Park is a wonderful celebration of this. This free event is one of the largest outdoor events in Richmond, and a nationally rated juried arts and craft show. Also, just one of the best ways to get out and celebrate spring at Byrd Park. May 19-21- Dominion RiverRock- So much to do and see at this one, and it combines all our loves- the James River, getting outdoors, art, food, drink, and music! Seriously fun for the whole family, and always something new to see! June 1-4- Richmond Greek Festival- Celebrate Greek culture with music, dancing, vendors, and absolutely delicious food! (Fun fact- when my son was a baby, he wouldn't touch green beans until he had the ones from the Greek Festival, so I got the recipe and made them all through the toddler years!) Grab some friends, a couple of bottles of greek wine, and spend the day. It's a true Richmond tradition! July 14-15- Hanover Tomato Festival - Even those of us who don't live in Hanover claim the almighty Hanover tomato, and for good reason. They really are the absolute best. (I even know someone who moved far away but took a truckload of Hanover soil and plants to try to take them with her!) This is a celebration of the tomato, with lots of fun for the whole family (pet friendly, too!) July 29- Beer, Bourbon, and BBQ Festival- The 14th annual, and need I say more? There's music, tastings of all your favorite "B's" and lots of vendors, too. At the Meadow Event Park in Doswell. August 12- Jam Packed Craft Beer and Music Festival- Just what it sounds like. This festival starts at 3:30 on Saturday, and August 13- Carytown Watermelon Festival- Food, music, vendors, fun, and of course, watermelon! (I mean, SO MUCH WATERMELON!) Super family friendly, lots of fun, and free! Obviously this list is not exhaustive, and there are PLENTY of other smaller events on Brown's Island and around town to learn more about RVA, our rich culture, and try great food and drink, enjoy music, and just have FUN. Where will you be going??

Read more