Richmond Real Estate

Keep on top with latest and exclusive updates from our blog on the Los Angeles real estate world. Cindy Bennett Real Estate posts about tips and trends for buyers, sellers, and investors every week. Whether it be about staging your property or a snapshot of the market, this is your one stop shop.

If you're buying a home and you write your offer you love the house, the thing that you love the most is that fantastic chandelier in the dining room, and the adorable dog house that looks exactly like the house you're buying. Make sure you write those things in. Here in central Virginia, our contract actually lists out the items that are automatically assumed to be staying when you buy your house. So they're automatically in the contract. We don't need to write those in. They are technically things that are attached to the house, which means fixtures, fans, curtain rods, blinds, dishwashers, microwaves, and stoves. That's basically it. Now, some of the gray areas can be mirrors in the bathroom, sometimes they are attached. And sometimes they're not refrigerators. Well, they're always attached the same way a stove is, why are they not included? I don't really know. But they're not. So we always write those in. If we're buying a home, and you want to keep that refrigerator or the washer and dryer, we're gonna have to write those in because they're not automatically included in the contract. But I would go a step further and say, that if you absolutely fell in love with that chandelier in the dining room, and the seller wants to take it, they should have excluded it. But if we know we want to keep it and we know we don't want any hurt feelings, or kerfuffle, as we go through the process, we go ahead and write that in as well. So to be safe, we're always going to write in all of those little extras, but probably not the window blinds in the bathroom, and probably not the ceiling fan that's in the rec room. If you're looking at homes online, and you are not working with a realtor, I'd love to help you figure out exactly what you're looking for and what's going to stay with that home when you purchase it. So give me a call and let's chat and I can help you navigate that entire process.

Read more

So what do I do with my dog or my cat or my ferret or my bird or whatever if I'm getting ready to show my house? Your pets themselves. The physical beings. Make sure that you either have your, especially dogs, make sure that you have them created or in a comfortable spot where the potential buyers can actually see the home, but your animals are not going to be underfoot, scaring people, potentially running out the door, or anything else. My best advice, give them to a friend or family member or board them for a couple of days, at least when you first start the showing process. Get the dog hair off of everything. If you have pets that make a mess, or you've got dog toys, or cat toys, or giant cat towers everywhere that are distracting for a potential buyer, get those out of the way. Do a deep clean. Get the evidence of your lovely fur babies out of the way so that people can make an objective decision on their own. I'm going to go back to that same thing from number two and reiterate the cleaning. Lots and lots of people will run the vacuum and think that's good enough but I'm telling you a deep clean will really make a difference and get away some of the smells that we sometimes as they say become nose blind to. That goes to the backyard too. Trust me nobody wants to take a look at their potential new backyard and find that they have stepped on something on the way back into your house. That's not good for anybody. Trust me. If you're thinking of selling following these tips are really going to help you get your home on the market if you do have pets. It will make it easier for people to see your house for people to show your house and for your pets to not have to deal with strangers coming in all the time. If you have any more questions, I'd love to help you get your home ready and your pets ready to make the move that you want to make.

Read more

Marry the house date, the rate, marry the house date, the rate. This is something that if you spend any time on social media, and you've even dipped your toe into thinking about real estate, you've probably heard or seen someone say. It's a phrase that I kind of hate because I think it minimizes the whole experience and doesn't really talk about all of the nuances, but let's unpack it a little bit and look at that phrase in terms of the current market, and why it might be worth digging into a little bit. So simple economic principles, say if inventory is low and demand is high prices are going to go up, we have been in a historically low inventory situation in housing in the entire country for a while now. And that will continue for a while longer. So while the high interest rates have sidelined, some of the I'd like to buy a house people, there are still lots of people who actually need to buy a house and it has not sidelined them. So there's still a good amount of demand, and not a lot of inventory on the market, which means prices will likely continue to rise, despite the fact that interest rates are high. So while they are expected to go down in the probably first/second quarter of 2024, they will first of all, maybe never go back to 3%. So if you're waiting for that, like as my father used to say, if you're waiting for that you're backing up. You're not going to get anywhere, because that's very unlikely to happen. But even if they go down, when they go down, those prices are not going to go down at the same time. Because obviously, interest rates go down, those prices are going to go up because all of those I'd like to buy a house people are going to come back into the market. So demand will go up, and inventory is not going to change radically. And those prices are going to continue to escalate. So if you're thinking about buying and you are particularly renting in the meantime, if you can afford it, if you're ready, buying now is probably going to be a better financial decision than paying rent until six months or a year down the road, when maybe rates are lower, but prices will almost definitely be higher. So if you're thinking about buying or you think, you know, hey, maybe I'll buy a house in the spring, I'm going to save up more money, or whatever your thought process is. If you're thinking of buying anytime in the next six months to a year, give me a call, and let's talk, break down the numbers, look at what the projections are for the area and the type of house that you're looking at, and the price range. All of those things go into figuring out these numbers, but I'd love to talk to you. I'd love to help you determine if now is the right time or if it's the good time to wait and help you make those calculations that fit your personal finances and life plan.

Read more

So believe it or not, even in this market, pricing is incredibly important. And if you're wondering why your house has been sitting or why a house hasn't gone off the market that you've been seeing over and over in your search, if you're buying, it is price, it is literally always price. When I was a pretty new agent, I remember sitting in the office, and there was an agent who had a listing that hadn't sold very quickly. And this again, was a long time ago when things didn't fly off the market like they do now. And she was asking everybody to take a look at her listing and see if they could tell why it hadn't sold. And even brand new, I said, I think it's the price. I think you need to drop the price. And she was indignant that it was not the price that it wasn't always the price. But, if you really think about it, think about you having a great house in a great location, but the condition of the house is rotten - price. You have a weird house in a great location, in great condition, what's going to move it - price. If you have any combination of those factors, and one is off, those are generally things that you can't change, or you can to some degree condition, yes, you probably don't want to totally renovate a house if it's got an unusual floorplan. So price is going to be a factor. And obviously, location, location location is something we say for a reason. And that's because it can't be changed, but what can be changed, is always the price. So this goes back to having a consultation and walking through with your realtor when you are starting to think about selling so that doesn't mean if you say I want to sell my house in September, that's when I want to sell that's when I want to move. You should be in a perfect world at least calling your agent a couple of months before so that we can come through, walkthrough, and tell you, Hey, you're going to get more bang for your buck if you paint, if you replace the front door, if you do a little landscaping. All of those little things can improve the condition which can maybe maximize an unusual floorplan and make it seem more livable. So if you're curious about what you might need to do to get your home ready for sale, or if you know you're going to want to sell your house in a couple of months I'd love to talk to you just give me a call. Reach out and let's set up a time to chat and I can walk through and give you a to-do list that will help you get more money for your home because it really is always price.

Read more

Dreams versus reality. Here are a couple of things that I implore you to please not do if you are thinking about starting to look for a home. In a perfect world, when we start looking for that perfect home for you we are able to find something that fits all of your needs, is going to be able to be your forever home, and is of course going to be totally Pinterest-worthy. The problem is that sometimes the Pinterest dream does not hit the budget reality. And if you're starting to shop for a home, whether it's your first home, your fifth home, or anything in between, our budgets are just a little bit less than what our dream looks like it's going to be. So while I do always encourage buyers that I'm working with to fill out a have-to-have list and an absolutely not list, make sure that those are actually giving you enough opportunity to be open to the possibilities that are actually available in your budget. Because otherwise, trust me it is a very discouraging process. Make sure that when you're talking about, thinking about, and writing down those must-haves they're things that are actually possible within your budget. And sometimes that really means looking at your whole house budget, your whole life budget, and talking to a lender to get that pre-approval number first. But remember, your first home doesn't have to be your forever home, your second home doesn't even have to be your forever home. So, spend more time with the lender and your budgets and looking at the houses that are actually available, rather than spending your time building your dream mansion that may be completely unattainable at this point in your life. Trust me, you can get there, but sometimes it takes a couple of houses to land where you really, really want to be. So when you're writing that list of must-haves and absolutely do not want to make sure it's a little more rooted in reality and a little less rooted in Pinterest. Sometimes it's really hard for those things to match perfectly, but we can usually get pretty close to the things that you need, the things that you want. And a lot of times a little special touch from you will get right back into that Pinterest or Instagram category. If you want a copy of my buyer's guide, or you're thinking about starting to look on your own, give me a call, reach out, or send me a message. I'd love to talk to you and help you get started building that wish list for that home that you might be ready to buy in six weeks, six months, or even a year. I'd love to talk.

Read more

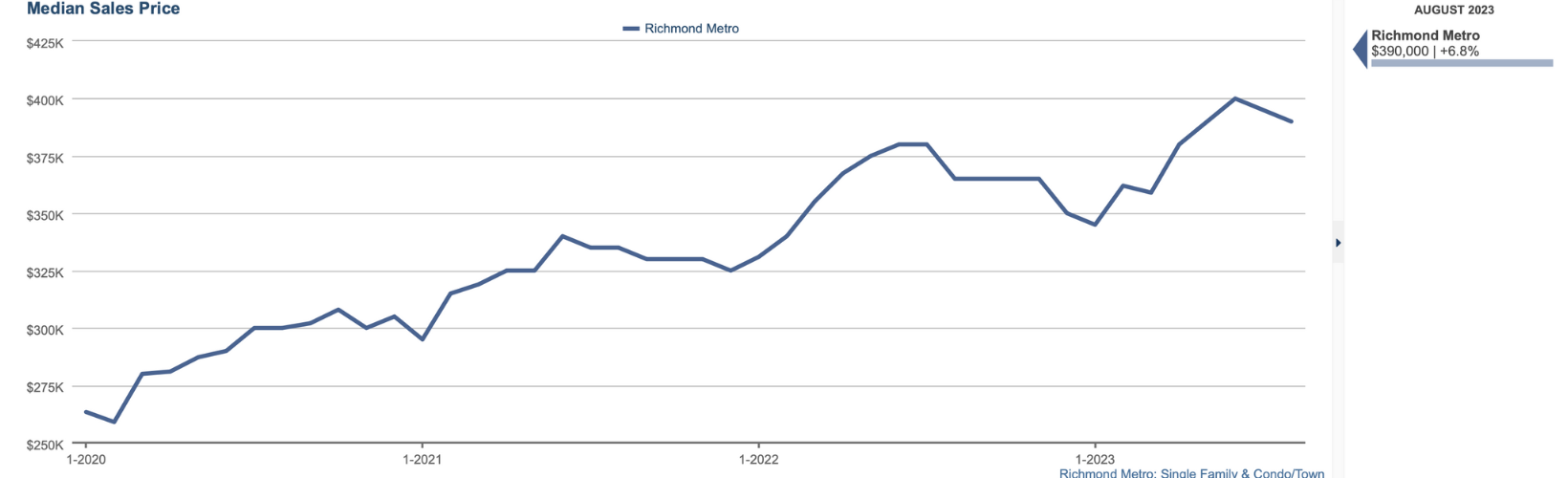

In terms of the real estate market, this summer was definitely a bit different than the last two, in large part because the interest rates went up by 2x since last year, and that's had quite an impact (to no one's surprise) on the market as a whole. Where will it be this fall? Here's a little breakdown of where we are as we head into the fall market. As always, if you (or anyone you know) are thinking of buying or selling, or you simply have questions, please don't hesitate to reach out. I'd love to help! While the average sales price of a home in the area has dropped a bit from its high of $399,990 (June '23) to $390,000, it's by no means a large drop and tracks pretty well with seasonal trends. August always dips a little in numbers simply because the heat, vacations, back to school, etc., generally cause the market to take a bit of a breath before "back to business" in the fall. That average sales price number is up from $380,000 this time last year, so if the national media has told you things are cooling in some areas, we are not one of them that is. One bright spot in the housing affordability stress is that while our prices have gone up, they do not (generally speaking) appreciate the insane rates that some parts of the country has, and that's definitely welcome if you're buying. We're definitely still feeling the inventory shortage, with closed sales for August totaling 1140, vs last year's 1507. We still do not have enough homes to sell, despite the interest rate increases sidelining some of the people who would have liked to buy. As a result of this inventory crunch, we're still seeing homes sell for 102.3% of the list price, generally due to multiple offer situations. This is down only ever so slightly from last August when it was 102.5%. Sort of crazy when you do consider the 100% increase in rates since then. In fact, neither the days on the market until a home sells nor the number of showings until a contract has been received, has changed at all since last year. So when will this get better? It's going to get better, right?? The good news is yes, it will. The bad news? We're not sure when, or how much. Given that we were already in an inventory shortage prior to the rate increases, that's gotten considerably worse. According to Redfin data, 66% of homeowners in Virginia have rates below 4% (and 28% have rates under 3%). That means that for many of them, they'd nearly double their rate by selling and buying another home. There are always reasons that will make people need or want to do this, but the casual "I'd just like a new home," sellers/buyers are in most cases sitting this market out. If you're thinking of buying, you may be tempted to wait until rates drop, and I totally understand. Just don't think that prices will drop at the same time. With the inventory shortage likely to continue into the foreseeable future (most experts say that nationwide it may take a decade for our housing shortage to catch up), prices are likely to continue to go up. If rates drop a good bit, the prices are likely to go up even more. (That's just Econ 101- low supply will push demand higher). According to many experts (those experts again!), including Fannie Mae, rates are likely to drop to around 6% or so in 2024, but probably not until the second quarter. They're very unlikely to drop this year, though, so the market this fall is going to be... well, interesting. Historically, rates hover around 5-6% and that's certainly likely again, but please please please don't continue paying rent, and waiting for those 3% rates again. They will most likely never return. If you have questions about any aspect of the real estate market, I'm happy to help. Just drop a comment, send me a message, or give me a call! *All numbers and stats here are from info found in the Central Virginia Regional MLS, and based on numbers for the Richmond Metro area.

Read more

But won't I have to pay capital gains tax if I sell? This is one of the most frequent questions I hear. And I hear it from literally all ages, all demographics, everything. Capital gains taxes are some of the most confusing aspects of selling a home and everybody seems to have a slightly different interpretation. What are capital gains taxes? First of all, very simply, it's a tax that the IRS takes on the sale of an asset. So if you've made a profit on the sale of an asset, that is going to be taxed, just like your profits from anything else will be. Long-term is if you've held the asset for more than a year. Short-term is if you've held the asset for less than a year. Obviously, short-term gains are going to come into play if you're flipping a house, but let's just talk about regular home ownership. Selling a house, short-term gains are going to be, even if it's your primary residence that you haven't lived in for a full year, you're going to take what you paid what you can sell it for, but then you're going to subtract those things that you added or changed. And that's going to be your gain. You're only paying tax on the profit. So consult a tax professional, but that's just going to be taxed as part of your regular income, just like you made money on anything else. Long-term gains are paid on any home that you've owned for more than a year. Now, that's going to include your primary residence and a rental property, second home, that sort of thing. And again, I'm going to tell you to consult a tax professional, because I am not a tax professional. Long-term gains become a little trickier because there is an exemption for your primary residence. And I'm not going to get in the weeds here, but that exemption is going to be basically $250,000 if you're a single individual, and $500,000 If you're a married couple filing jointly. So if you have lived in your home as your primary residence for two of the last four years, you are going to be exempt from those caps for the sale of your primary residence. But what if it's not your primary residence, it's a rental property a second home, or something like that there are different tax rates based on your income for those capital gains, again, consult a tax professional, I'm not one, but those rates are gonna differ based on your income. And if you're in a lower income tax bracket, like you make under $43,000 a year, you're not going to pay gain at all. But the long and short story is capital gains are not as scary as they seem. And just make sure you have all the information before you're putting your house on the market. So if you're curious about selling your home, I'd love to talk to you more about the actual sales process. But I am going to tell you to consult a tax professional if the gains and the tax on them are something that concerns you. If you need a good tax professional, I know lots and I'm happy to refer you as well.

Read more

When you're getting your home ready to sell, not all dollars are created equal. Obviously, you want to be doing maintenance all along as you're living in a home. So things like maintaining your house and maintaining the exterior of your house. But when we're looking at getting a home on the market, even if it's six months from now, there are some things that you're going to have to put money into that are not going to feel like the high ROI you would like them to be, I'm going to list a few of the maintenance and then I'm going to list a few of the high ROI items that you can do. A balance of those is gonna give you a really good outcome when you go to sell. So here are my top four in each category. Trees and yard. You want to make sure that your trees are not dead, they don't have dead limbs, they're not hanging over the roof, they're not hanging over your driveway or shed or garage. Because as soon as somebody sees a dead tree or a tree that's threatening the house, they're going to add that to their list of projects. And right now, when people are adding to that list of projects, they're not necessarily coming in at a lower price where they would negotiate. Often they're just backing right out the door and getting in their car to get to another house that seems like less work. Plumbing and electrical is the number two and probably in my opinion, the most important. Make sure everything flushes that your outlets work, lights work fans work, and that things look like they're in generally good condition. Your systems. Your HVAC, your water heater, and any sort of systems you have, really need to be in good working order too. Finally the roof. Make sure you don't have any roof leaks, make sure that there's no debris on your roof, and that it doesn't look stained or damaged. And certainly that it's not damaged so that buyers feel really solid when they come in and get excited about the things that you have to offer. Rather than making a list of things that they feel like they need to do. Here are some of the things that add value very definitively. do a little bit more to that landscaping. Make it actually look good. Put mulch down, plant some shrubs, that type of thing. That generally returns about 100% on your investment. That is just a no-brainer. The minor kitchen remodel. So that may be painting your cabinets and maybe just adding new appliances. Maybe it's just putting on a new countertop. It doesn't mean gutting redo the whole kitchen. But that minor kitchen remodel has an ROI of about 98%. Ideally, you do this a few months before you move and you actually can enjoy it as well. A minor bathroom remodel. Same thing. it actually has an average ROI of about 102% anything that gives it just a little extra update a little extra pizzazz, brings it into 2023. You're gonna be in good shape on those. And finally, did you know that you can get a 90% ROI on just replacing your front door? Make sure that you're not only focusing on those ROI things, you're also focusing on the things that are going to negatively impact you if you don't do them. I always will take the time to come to visit your house, and make sure that we've got a solid list that's prioritized other things that you should do when you're getting ready. And that means call your agent, ideally me, before you're even really ready to sell. Six months away, four months away, so we can get all those things done to give you the highest net result possible.

Read more

So great, waving an inspection is a great way to get your contract at the top of the heap in a multiple-offer situation, but should YOU do it? I am going to tell you that if you don't have some sort of risk tolerance, don't do it. But if you do have a little bit of risk tolerance, there are ways to get around it. So you can pay an inspector a couple of hundred dollars to walk through the property with you and give you a general idea of how those systems, that you may not know how to assess, what kind of condition they're in. But at the end of the day, you are 100% going to have something happen, whether you have an inspection or not. I call these oh s**t moments, it might be six weeks, it might be six days, it might be a year. You can also buy a home warranty, the seller can buy a home warranty for you, or you can buy one yourself, but they're not going to cover everything. So you're still going to need a buffer. It is always a bit of a risk when you have a home that things might go wrong. So if you are on a razor-thin margin, a razor-thin budget, and you can only afford your mortgage payment, that may not be the house you want to buy anyway, inspection or not. But ultimately, your options are probably to pay way more than the asking price and ask for that inspection, giving the seller some sort of security, that they're going to have still a higher offer, even if they end up with items that they have to repair. Or you're gonna still probably pay more than you want in this market and waive the inspection. It's kind of up to you and where your risk tolerance is. But remember, at the end of the day, if everything is equal, that seller is always going to pick the offer that is the least risk for them. So the more risk you can take on the better price you are going to get on the house that you're purchasing. If you want to take a look at more ways to build an offer, write an offer, or buy a home in general, check out some of my other YouTube videos. Or better yet, give me a call. I'd love to talk to you and I'd love to help you find your dream home.

Read more

If you are under contract, and on your way to closing, you're super excited, you've started packing, and you started envisioning how you're going to design your space, here are a few things that you don't want to do if you actually want to close on your house and close on time. First of all, don't buy a car. Please, for the love of all that is holy, don't buy a car. If your car dies, and I have had clients for whom this happened, they have had to bite the bullet and buy a car in between contract and closing. But call the lender, let them know the situation, let them know what's happening, and ask them what to do before you go off half-cocked and do it. Because that can really impact your debt-to-income ratio and that can throw your loan way off track. Second, don't drag your feet on getting information to your lender. They do not want to ask you for a thousand documents and have to keep up with all of those things any more than you want to provide them. But they will not ask you for something they don't need. And as frustrating as it is. And as much as you want to yell at, you know, Marjorie that called you yesterday. And now she wants three more documents. It is not her. So don't yell at her. Just give them the documents they need because there is a process that they have to follow. And their systems going to tell them, oh, now we need this. And yes, sometimes that's the last minute. Third, don't quit your job, even if you get a fantastic job offer. Try to wait out the old job until closing and then take the new job. Yes, you can get a loan if you've been in the same career, same field for the last couple of years. So it may be fine, but it also may not. The best rule of thumb is to try to keep everything the same as it was when you made a loan application. And keep it that way until closing. If you have any more questions about the financial process or what it takes to get a loan and get into a home, I have some terrific lender partners that I'd love to put you in touch with and they would be happy to help you with that side of things. If you have general questions about buying or what it takes to go from contemplating a purchase to contract to close. Give me a call. I'd love to answer any questions you might have. And obviously, I'd love to help you get into the home that you want to be in.

Read more