HomeBuying

Keep on top with latest and exclusive updates from our blog on the Los Angeles real estate world. Cindy Bennett Real Estate posts about tips and trends for buyers, sellers, and investors every week. Whether it be about staging your property or a snapshot of the market, this is your one stop shop.

As the summer winds down (a bit at least), the market has not changed a whole lot from the last couple of months. Inventory is still tight, leading us to remain in a solid buyers' market. Check out the graphic here for a little snapshot of what's going on, and how it compares to the past few months. Listing inventory has actually been dropping consistently over the past few months, and is nearly half of what it was this time last year (which was already a low inventory point for our market.) As rates have risen, there is definitely less motivation for homeowners to sell, as many have refinanced to very low rates in the past few years. Until this situation improves, our inventory is unlikely to grow by much. That means, if you are thinking of selling, it's still a great time. Despite interest rates, there are still lots of buyers out there, and terms for sellers are more easily negotiated (not only price but repairs required, closing dates, etc) right now. If you're buying, yes, rates are not terrific, and inventory is low. However, if buying is something you want or need to do, all hope is not lost. We have found our clients a number of homes off the market in the past year, putting them in better positions to not have to compete and find the home they love, so that is always an option. When you're working with me as your buyer's agent, my goal is to do all I can to get you where you want to be. In better news, most experts predict rates to begin to move on a downward trend through 2024, as long as the inflation numbers continue to look good. That's a glimmer of hope. Just remember, as rates drop, prices and competition, are likely to increase. Not a whole lot of things in life are guaranteed, but the rules of supply and demand are. If you want to know what all of this means in terms of your personal situation, give me a call, and let's chat!

Read more

So I have lots of clients, especially millennial clients, who frankly could live in a one-bedroom apartment for the rest of their lives and be totally fine with it. But the one thing that they're going to buy a house for... their dog. We are actually seeing more and more people buy homes for their dogs or their pets. So, if you're one of those people that is thinking, I want to buy a house, but it really has to be a good fit for my dog, here are some of the things that you want to think about. First of all, you want to make sure it has a yard, probably a fence. Fences are not cheap. So if you find a house that has already got a fence, that's definitely a win. Is it a walkable neighborhood? Is it somewhere that you're going to go out and take your little guy for a stroll in the evenings or before work? Do you feel comfortable doing that? Are there sidewalks? Is there a good shoulder that's going to give you a lot of space? Richmond is such a dog-friendly city. We've got lots of cool dog parks and cool places to go. You can bring your pet from breweries to dog parks and that's just a great way for you and your pet to meet new people and dogs. So if you're one of those people that is looking and really wants to be dog-centric in what you're looking for to call home, I'd love to help you. Maxwell can weigh in. He won't necessarily be at every show but he will give his opinion.

Read moreIt's hard to watch or listen to the news on any platform lately without getting some sort of news on the housing market. To hear the national news, things have cooled tremendously, but we all know that real estate is really local, right? The story around here is, more or less, a simple tale of supply and demand. A six month supply of housing units is widely considered to be a balanced market (neither buyer nor seller’s market), and we are still in a market with only just over 1 month’s supply. That means the simple concept of supply and demand is going to keep prices steady for a while, and in many pockets of our market, keep things competitive. (For perspective, in February of 2022, the inventory low- we had only .7 months.) For the same sort of perspective, in February or 2022, we only had 1544 active listings in our MLS, and this February, we closed out with 1792. That’s just not that big of a jump, and the buyers are still out there. In fact, homes last year this time were selling on average for close to 107% of listing price, but this year, they are still selling at nearly 98%. (And that’s an average. The median list price to closing price percentage is sitting at 100%) Last January, the average sales price of a home in the area was $378,029. This January, that price is up to $388,060. Yes, that’s up, for sure, but it’s important to note that the average price in May 2022 was $435,893. Does that mean the market has dropped/cooled/changed? Well, sort of. Things have definitely been flattening out from the wild spikes of the last couple of years, and if you were hoping to get on the market and garner 20 cash offers with huge escalations and no inspections, you may well have missed that boat. However, despite what you hear on the national news, our market is in a much softer correcting cycle than many in the country. Anecdotally, we have seen more and more buyers be able to have home inspections, appraisals, etc, over the last few months. That's been a very welcome change for the buyers out there, and we are still seeing them, but perhaps to a lesser degree at the moment. As we head into spring, and the spring market, we're definitely seeing more of those multiple offers, and more situations where those things are being waived again. In short, while rates have definitely gone up, there are still lots of buyers out there looking for homes, and just not enough homes out there for them. While we do anticipate that inventory loosening up a bit as the weather warms, we definitely need more listings! If you're thinking of selling, it's definitely a great time. And if you're thinking of buying, we can get you where you want to be! What will it take? Just a little bit of planning, a little creative/out of the box thinking, and yes- patience. If you have questions about the market, or just your little section of it, reach out! I'd love to break down the data that matters for YOU. *Graph and data- MarketStats by ShowingTime

Read more

Whether you own a home, want to own a home, want to sell a home, or just like to keep up with the news, you've probably been hearing plenty about the real estate market, interest rates, and all the attendant chatter. To misquote a quote, the rumors of a crash have been greatly exaggerated. Here in the Metro Richmond Market, where I also pull my numbers unless stated otherwise, we've definitely seen a shift- anecdotally as we've seen more inspections granted, fewer multiple offer situations, and more negotiation on the part of buyers (cue sound of buyers rejoicing everywhere). By the numbers, we see basically the same thing, but you sort of have to look a bit closer to really see what's going on. In November, the average sale price of homes in the Richmond Metro area dipped to $421,017 from $423,438. Not a huge drop at all. BUT, if you look at the median, you'll see that the median sales prices has actually been totally flat since August at $365,000. In addition, while the median list price to sales price ratio has been flat at 100% since September, the average has dipped to 99.9%. That's no kind of crash. A leveling, or an adjustment for sure. But considering that the high of April 22 was 107.5%, that is a drop indeed. Basically, you're still not "stealing" a house here in the Richmond area, but if you were looking over the last 6 months and got tired of crazy multiple offer situations. those have largely dissipated. While we may see some *great* homes that have multiple offers, most homes now do not. Can you get homes with an inspection and/or negotiate a price reduction or some concessions? You absolutely can! It's happening pretty consistently, in fact. If you're selling, 100% of list price still doesn't sound too bad, does it? Just make sure you have an agent you trust to help walk you through the process, from prep, to pricing. Do you have more questions on the market? I'd love to help!

Read more

I don't think there's anybody at all that thinks they can buy or sell the home and not spend any money between the contract to closing, but a lot of times people are a little confused about exactly who pays what and what are they going to have to pay. So here's a little breakdown of that whole scenario. And whether you're the buyer or the seller, what you're going to have to actually outlay before you get to the closing table. So remember, on the buying side, you're obviously the one that's going to spend the lion's share of the dollars even though you may be saving for those closing costs and the down payment, remember, there are a couple of things that you're going to have to pay before you actually get to the closing table. First of all, when you write that contract, you're going to have to put an earnest money deposit. Generally, this is going to be about 1% of the purchase price of the house. So if you're looking at a $400,000 house, that earnest money deposit is going to need to be about $4,000. So that can generally be paid by check, cashier's check or a money order or wire transfer, but it gets paid right then and yes, it gets deposited. We're not putting that cheque in the desk drawer until closing. However, that money does get applied towards your final closing costs and down payment number so it doesn't just go away, but you are going to have to pay that at contract. The next thing you're going to have to pay is going to be your inspection. That's going to get paid directly to the inspector, generally going to be between five and $600, depending on the size of the house, and it may end up being more if you have additional inspections like radon, electrical, roofing, etc. The third thing you're going to have to pay out of closing, and this may well for most people be the last thing you're going to have to pay outside of closing, is your appraisal. Keep in mind that appraiser wants to get paid whether your deal goes through or not. So they're not going to count that as one of your closing costs. That's generally going to be between five and $600 or so, and that is going to be required to be paid by the lender out of your pocket before closing. Once you get to the closing table, you can estimate that your closing costs are probably going to be between 2% and 3%. A lot of that depends on the type of loan, the lender, and all that good stuff, but that's going to cover all of your insurance, your taxes, your title search, your title insurance, all sorts of little fees like wire transfer fees, and such generally between 2% and 3% of your total cost, in addition to your down payment. Now what if you are the seller in the transaction, your final closing costs number is probably going to be less than $2,000. In most cases, it's going to be between $1,000 and $1,500. That's going to cover the fee for the attorneys to prepare your deed and again, all the city, county, and state taxes because everybody wants a little piece of the action. The other thing that you're going to have to pay for as a seller is the termite inspection. That's the only inspection that the seller pays for not the buyer—generally about $100. The buyers also going to have their inspection so if they want repairs done and you negotiate repairs, you're gonna have to pay for those too. Whether you are on the buying side or the selling side there are definitely costs but they are a whole lot easier to swallow when you know about them ahead of time. If you have any questions on either side of the transaction or if you need help buying or selling a home I'd love to help you give me a call! Have questions I didn't answer? Send me an email or dm me on Instagram @cindybennettrealestate.

Read more

Let's discuss what I mean by "referral platforms" and what happens when you start your home search using one. Have questions? I'd love to help answer them! Find me on Instagram @cindybennettrealestate or send me a message with the chat button below.

Read more

Well, it's been a minute since I bought my first home, but it occurred to me that there are some things that I really wish I had known. So here are the seven things that I wish I had known when I bought my first house. Number one, as soon as you start looking at Pinterest, scrolling through apps, and looking at homes, find yourself an agent. Whether it is your next-door neighbor's best friend, or you find someone online on social media, ask your friends, ask your family, and find an agent that is going to work for you. Number two, the listing agent represents the seller. So if you are scrolling through homes online, and you roll up into an open house on a Sunday, and you love it, the only agent that you have now had any sort of communication or relationship with is the agent that represents the seller, that is not necessarily the agent you want representing you. Number three, don't be afraid to ask questions. And I mean, ask questions, there is no stupid question. Ask your lender, ask your friends, ask your agent, and make sure that all of your questions get answered, I see this almost more with folks who have purchased multiple homes than I do with first-time buyers. So even if you've bought five, six, or ten houses, you probably haven't bought them this year in this market, and maybe not in this state or in this city or county. So don't hesitate to ask, I promise we're not going to judge you and think it's a stupid question. Number four, know your numbers. So you're obviously going to be saving for your closing costs and your downpayment, and all of that stuff. But remember, you're going to want to furnish that house too. You might want to buy some plants, you're gonna have to pay for movers. So make sure that you're accounting for those things. I have some great checklists and your agent probably does too. Make sure that you're preparing for all of those circumstances that are going to come up. Number five know the disclosure laws. Here in Virginia, we are a buyer-beware state which means the seller doesn't have to tell you all of the stories about the times that the pipes leaked or anything else. They are going to say as far as we know, it's okay. Unless as far as they know, it's not. They are required to disclose if they know there's a problem, but proving that they knew or didn't know later is very difficult. Have an inspection with an inspector you trust and again, ask questions. Number six, just to reiterate, have an inspection. You can have any and all inspections as long as you have listed those in the contract and agreed upon that with the seller in your contract for purchase. So not just a whole house inspection, but if you're particularly concerned about the roof, you can get a roofer out there to check it out. You are going to pay for all those inspections but it is a whole heck of a lot easier to do that than pay for a new roof after closing. Finally, number seven, lean on your agent. This goes back to selecting an agent that is somebody that you are comfortable with, comfortable asking questions and comfortable getting referrals from. My clients call me years, months, whatever later and asked me for a great lawn care person or a great gutter guy. If you want somebody who can be a resource, make sure you have all your information. I promise you a will make the process so much easier. If you are looking to buy a house I would love to talk to you. I am happy to help answer any questions whether you are here in the central Virginia region and I would love to help you but I have agents and friends all over the country that I can put you in touch with to give you the same level of service.

Read more

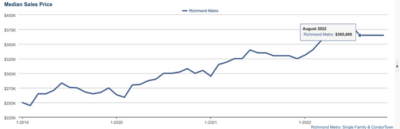

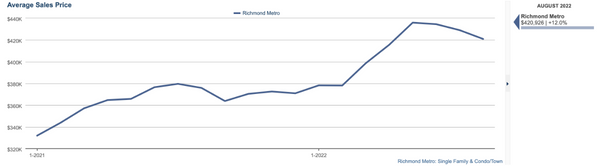

As we close out yet another "unprecedented" summer, it's a great time to check in on the market and give you a few numbers, but also a breakdown of my assessment on things. Here in the Richmond area, we have definitely seen things cool a bit, but it's by no means ground to a screeching halt. A few things to note, number wise. (These are numbers for the Richmond Metro area, so the city and surrounding counties) The average home price has finally dipped a bit month to month, dropping from $429,015 in July to $420,926 in August. If you look at this graph, you'll see how prices have trended generally over the last year, and it's been pretty steadily increasing all along, until now. (July was a bit lower than June as well.) Days on Market has actually gone up in August over July as well, with the average home now staying on the market 15 days instead of 11. Yep, these are not huge differences month over month, and they are still stronger numbers than last year at this same time. We are very much still in a market with low inventory, and we still have a bit of a backlog of buyers that are still looking for homes. So what does this all mean if you are one of those buyers still looking in this market? Good news! We are seeing more negotiation for buyers, with people able to actually "make an offer" in some cases, as well as have full home inspection and appraisal clauses in their contracts. This is something we haven't seen in some time, and as someone who works with a LOT of buyers, I have to say it's a welcome change! But what if you're selling? Have you missed your window? Absolutely not. As I mentioned before, we still have fairly low inventory, and that means there are still more buyers than sellers, and pretty high demand. Did you miss the window of multiple offers with no contingencies and way over asking? Maybe. We are still seeing plenty of multiple offers, but that's a bit unpredictable, even in the "hottest" of areas. If you need to sell, though (or just want to sell), it is still a good time, just in a more normal sense of good, rather than totally crazy like it was 6 months ago. Do you have questions about the market as we head into fall? I'd love to help you get your questions answered, and make sure you have all the information to make any move you need or want to make. Call me!

Read more

Okay, so let's talk about rent backs. What is a rent back? That's something that we're hearing all over the place in the market the last year. So, lots of sellers want to stay in their home after they close because maybe they haven't found a home or maybe they have found a home, but they can't move into it right away. So, when you hear the term rent back bandied about basically what that means is the seller would like to retain possession after closing for a fixed period of time. But how does that work? I mean, it sounds like a great idea, but how does that impact you with the buyer of that home? So when we do a rent back, we use what is called a possession by seller agreement and basically, it's just like a lease, you basically become a landlord for whatever it is that you and the seller of the home you're buying have determined you want to do. There are all sorts of ways to structure this. But yes, you do own the home after closing. Yes, you do want to make sure your homeowners insurance covers it. Every little detail of that process needs to be in writing and you need to understand that you basically have a tenant. So, if the washing machine breaks, it's on you, not them in most cases. So, there's lots to go into that. But remember, if you want to do something like that, that is outside of the details of the actual sales contract, we need to have all of that in writing to avoid any confusion and make sure everyone is covered. So remember, anytime we do anything in a real estate contract, listing or selling, we want to have everything in writing. If you have questions about any of those details, or you have an unusual situation, reach out to me I'd love to answer any of your questions.

Read more

We've all heard that old adage, cash is king many, many times. But what do you do if you're trying to buy a home in this market and you don't have a dump truck full of cash? Let's unpack that a little bit. Why is cash king anyway? Well, it's all about risk, right? The seller wants to make sure that what you offer them is what they're going to get at the end of the day, and it's guaranteed not going to have any unexpected loopholes throughout the transaction. There are some ways that we can make your noncash deal as competitive or close to a cash deal without you having to have piles and piles of cold hard cash. A few of those things that are going to help your noncash offer feel more like a cash offer to that seller are going to be waiving the inspection or making the inspection less of a question mark for them. Waiving the appraisal or making the appraisal less of a question mark for the seller. So that's coming up with a little bit of extra cash if the appraised price and the purchase price don't quite meet. And another is, and perhaps the most important make sure that you are well qualified with a local lender who might even talk to the listing agent to let them know how solid your offer and your qualifications are. If you have any more questions about writing the perfect offer in the seller's market, I'd love to talk to you. Give me a call, send me a message. Shoot me a DM and let's get started.

Read more