Selling Your Home

Thinking of selling a home? The time to start the process is now (when you’ve just started thinking, rather than when you think you’re “ready”) Read up, or better yet, reach out, and get all your questions answered.

When you're getting your home ready to sell, not all dollars are created equal. Obviously, you want to be doing maintenance all along as you're living in a home. So things like maintaining your house and maintaining the exterior of your house. But when we're looking at getting a home on the market, even if it's six months from now, there are some things that you're going to have to put money into that are not going to feel like the high ROI you would like them to be, I'm going to list a few of the maintenance and then I'm going to list a few of the high ROI items that you can do. A balance of those is gonna give you a really good outcome when you go to sell. So here are my top four in each category. Trees and yard. You want to make sure that your trees are not dead, they don't have dead limbs, they're not hanging over the roof, they're not hanging over your driveway or shed or garage. Because as soon as somebody sees a dead tree or a tree that's threatening the house, they're going to add that to their list of projects. And right now, when people are adding to that list of projects, they're not necessarily coming in at a lower price where they would negotiate. Often they're just backing right out the door and getting in their car to get to another house that seems like less work. Plumbing and electrical is the number two and probably in my opinion, the most important. Make sure everything flushes that your outlets work, lights work fans work, and that things look like they're in generally good condition. Your systems. Your HVAC, your water heater, and any sort of systems you have, really need to be in good working order too. Finally the roof. Make sure you don't have any roof leaks, make sure that there's no debris on your roof, and that it doesn't look stained or damaged. And certainly that it's not damaged so that buyers feel really solid when they come in and get excited about the things that you have to offer. Rather than making a list of things that they feel like they need to do. Here are some of the things that add value very definitively. do a little bit more to that landscaping. Make it actually look good. Put mulch down, plant some shrubs, that type of thing. That generally returns about 100% on your investment. That is just a no-brainer. The minor kitchen remodel. So that may be painting your cabinets and maybe just adding new appliances. Maybe it's just putting on a new countertop. It doesn't mean gutting redo the whole kitchen. But that minor kitchen remodel has an ROI of about 98%. Ideally, you do this a few months before you move and you actually can enjoy it as well. A minor bathroom remodel. Same thing. it actually has an average ROI of about 102% anything that gives it just a little extra update a little extra pizzazz, brings it into 2023. You're gonna be in good shape on those. And finally, did you know that you can get a 90% ROI on just replacing your front door? Make sure that you're not only focusing on those ROI things, you're also focusing on the things that are going to negatively impact you if you don't do them. I always will take the time to come to visit your house, and make sure that we've got a solid list that's prioritized other things that you should do when you're getting ready. And that means call your agent, ideally me, before you're even really ready to sell. Six months away, four months away, so we can get all those things done to give you the highest net result possible.

Read more

Summer is here, and that normally means a dip in activity for the real estate market, but over the last few years, "normally" is a term that we've all sort of tossed out the window. (I'm sure you know what I mean.) If you're wondering where we are in the Metro Richmond market, here's a little snapshot of what's going on right now, as we dive into summer... As of the end of May, the average home's sales price was $455,408. For a little perspective, that's up from $428,999 in April of this year, and $435,893 in May of 2022. This despite the fact that interest rates are up by over a full percentage point year over year, and of course, lots of predictions that home values would tank. Those predictions didn't amount to much, since the tight market of the last few years has, in fact, just gotten tighter. Why? There are a few reasons- we are in a legitimate housing shortage, as many builders either stopped or slowed building any type of housing units after the bust of '07-'08, whole new buying pool has dropped into the market in the past few years, and with interest rates rising, there are loads of people sitting in their home with a 3% rate not even thinking about selling and having to buy at more than double that rate. Ugh. I know. Frustrating (to say the least) turn of events! That shortage of inventory means that while last year (2022) seemed like the craziest ever with homes selling on average at 107% of the asking price, we've only dropped down to 104% a year later, with much higher interest rates. The average days on market in the Metro Richmond market is only slightly higher than a year ago. In May '22, homes were on the market for 12 days, and now it's 17. But remember, that's the AVERAGE. The median is exactly the same, at 6 days. My thought, though, is that that is a muddy data point. Many homes lately are going on the market with delayed showings, often going on the market on Wednesday, with showings starting Thursday, and offers being reviewed on Monday or so (or some combination of similar days). In other words, "sold in one day!" is often not happening, as showings run for a set number of days, with a deadline for offers. What does all this mean for you? At the risk of repeating myself, if you're thinking of selling, it's still a great time. With so few homes on the market, your odds of selling very quickly are great. And while you'll definitely maximize what you get for your home if you do some work like staging, painting, and repairs, you'll likely still be able to sell easily even if you don't have the time or money to do those things. (So if you have a house you've been wanting to sell, but don't want to "put the work in" to get it done, NOW is a great time to put it on the market!) If you're looking to buy, this is a market where having a great buyer's agent can really put you ahead of the pack. There are lots of ways to "win" a home in a competitive situation without giving away all of your money and peace of mind, but it definitely takes planning and strategy right now. If you're thinking of buying or selling in this market (or anytime), I'd love to help you get where you want to be. Let's talk! *Information here is based on numbers from ShowingTime/Market Stats, and CVRMLS **Numbers are for the Metro Richmond area only

Read more

It is a good time to buy? Is it a good time to sell? What's the market doing? These are just a few of the questions I always get asked as a realtor. Didn't answer your questions? Let's talk! DM me on Instagram @cindybennettrealestate or via my website at cindybennett.net.

Read more

You want to buy in Richmond, who are you going to call? The obvious answer is me. But if you're buying a home in New Jersey, California, Florida... or anywhere else? How do you even know where to start? Have questions? Reach out. I'd love to help. Find me on Instagram @cindybennettrealestate or at cindybennett.net.

Read more

Thinking that you have to wait until Spring to sell your home? You may want to consider selling your home this winter. I explain why in my latest Real Talk with Cindy. Have questions? Reach out to me, I'd love to help. Find me on Instagram @cindybennettrealestate.

Read more

Whether or not you're thinking of selling your house this Spring, this Fall, or Winter - or you just want to freshen up - I've got the Top 10 updates you can do while you're stuck in the house & it's cold outside. Want more tips? Reach out, I'd love to talk. Find me on Instagram @Cindybennettrealestate

Read more

As you might have heard, we are in a shifting market. Rates are higher, and the economy is a little more questionable. Let's talk about pricing your home in this adjusting market and what you need to keep in mind. If you have more questions, I'd love to answer them. Reach out to me on Instagram at @cindybennettrealestate or via my website at cindybennett.net

Read more

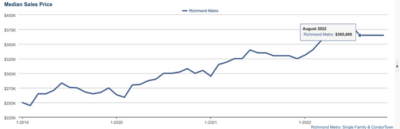

Whether you own a home, want to own a home, want to sell a home, or just like to keep up with the news, you've probably been hearing plenty about the real estate market, interest rates, and all the attendant chatter. To misquote a quote, the rumors of a crash have been greatly exaggerated. Here in the Metro Richmond Market, where I also pull my numbers unless stated otherwise, we've definitely seen a shift- anecdotally as we've seen more inspections granted, fewer multiple offer situations, and more negotiation on the part of buyers (cue sound of buyers rejoicing everywhere). By the numbers, we see basically the same thing, but you sort of have to look a bit closer to really see what's going on. In November, the average sale price of homes in the Richmond Metro area dipped to $421,017 from $423,438. Not a huge drop at all. BUT, if you look at the median, you'll see that the median sales prices has actually been totally flat since August at $365,000. In addition, while the median list price to sales price ratio has been flat at 100% since September, the average has dipped to 99.9%. That's no kind of crash. A leveling, or an adjustment for sure. But considering that the high of April 22 was 107.5%, that is a drop indeed. Basically, you're still not "stealing" a house here in the Richmond area, but if you were looking over the last 6 months and got tired of crazy multiple offer situations. those have largely dissipated. While we may see some *great* homes that have multiple offers, most homes now do not. Can you get homes with an inspection and/or negotiate a price reduction or some concessions? You absolutely can! It's happening pretty consistently, in fact. If you're selling, 100% of list price still doesn't sound too bad, does it? Just make sure you have an agent you trust to help walk you through the process, from prep, to pricing. Do you have more questions on the market? I'd love to help!

Read more

If you're thinking of buying in this market, you're probably going to need a home inspection, but it might look a little different than a home inspection a year or so ago. Let's talk about it! If you have questions, I'd love to talk to you or help walk you through the process. Send me a message or reach out to me on Instagram at @cindybennettrealestate

Read more

I don't think there's anybody at all that thinks they can buy or sell the home and not spend any money between the contract to closing, but a lot of times people are a little confused about exactly who pays what and what are they going to have to pay. So here's a little breakdown of that whole scenario. And whether you're the buyer or the seller, what you're going to have to actually outlay before you get to the closing table. So remember, on the buying side, you're obviously the one that's going to spend the lion's share of the dollars even though you may be saving for those closing costs and the down payment, remember, there are a couple of things that you're going to have to pay before you actually get to the closing table. First of all, when you write that contract, you're going to have to put an earnest money deposit. Generally, this is going to be about 1% of the purchase price of the house. So if you're looking at a $400,000 house, that earnest money deposit is going to need to be about $4,000. So that can generally be paid by check, cashier's check or a money order or wire transfer, but it gets paid right then and yes, it gets deposited. We're not putting that cheque in the desk drawer until closing. However, that money does get applied towards your final closing costs and down payment number so it doesn't just go away, but you are going to have to pay that at contract. The next thing you're going to have to pay is going to be your inspection. That's going to get paid directly to the inspector, generally going to be between five and $600, depending on the size of the house, and it may end up being more if you have additional inspections like radon, electrical, roofing, etc. The third thing you're going to have to pay out of closing, and this may well for most people be the last thing you're going to have to pay outside of closing, is your appraisal. Keep in mind that appraiser wants to get paid whether your deal goes through or not. So they're not going to count that as one of your closing costs. That's generally going to be between five and $600 or so, and that is going to be required to be paid by the lender out of your pocket before closing. Once you get to the closing table, you can estimate that your closing costs are probably going to be between 2% and 3%. A lot of that depends on the type of loan, the lender, and all that good stuff, but that's going to cover all of your insurance, your taxes, your title search, your title insurance, all sorts of little fees like wire transfer fees, and such generally between 2% and 3% of your total cost, in addition to your down payment. Now what if you are the seller in the transaction, your final closing costs number is probably going to be less than $2,000. In most cases, it's going to be between $1,000 and $1,500. That's going to cover the fee for the attorneys to prepare your deed and again, all the city, county, and state taxes because everybody wants a little piece of the action. The other thing that you're going to have to pay for as a seller is the termite inspection. That's the only inspection that the seller pays for not the buyer—generally about $100. The buyers also going to have their inspection so if they want repairs done and you negotiate repairs, you're gonna have to pay for those too. Whether you are on the buying side or the selling side there are definitely costs but they are a whole lot easier to swallow when you know about them ahead of time. If you have any questions on either side of the transaction or if you need help buying or selling a home I'd love to help you give me a call! Have questions I didn't answer? Send me an email or dm me on Instagram @cindybennettrealestate.

Read more