Real Estate Market Updates

Pretty self explanatory, right? The market is always changing, and remember, markets are very local! This is where you’ll discover the up to the moment info on the housing market in the Richmond area. Got deeper, or more specific questions? Send me a message or give me a call!

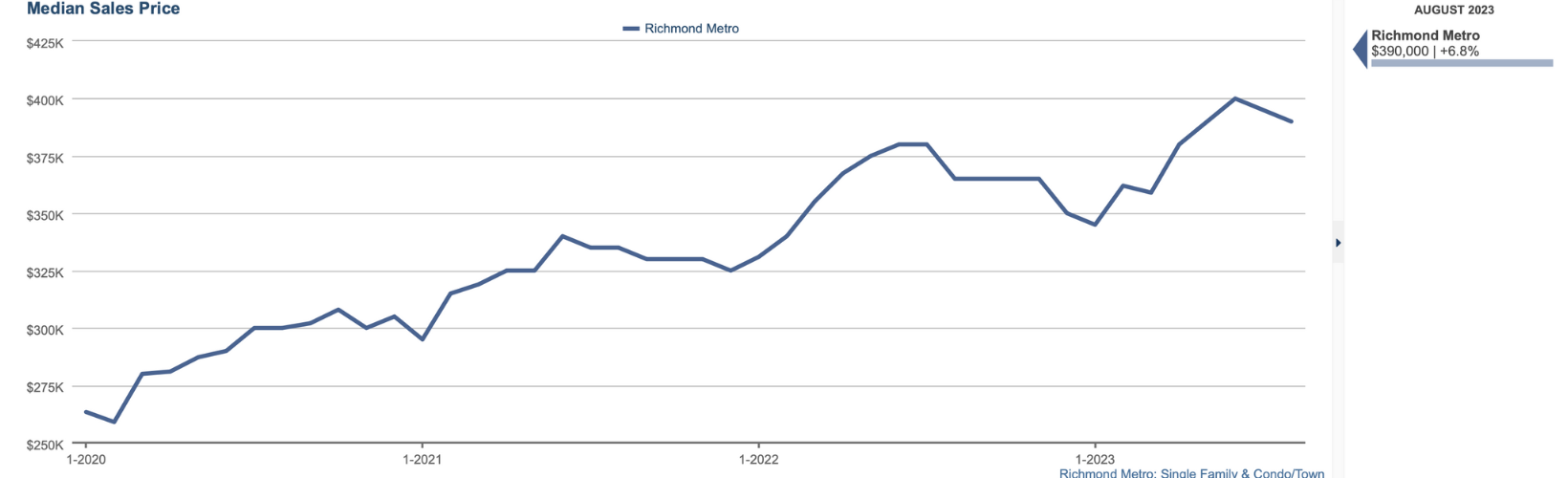

In terms of the real estate market, this summer was definitely a bit different than the last two, in large part because the interest rates went up by 2x since last year, and that's had quite an impact (to no one's surprise) on the market as a whole. Where will it be this fall? Here's a little breakdown of where we are as we head into the fall market. As always, if you (or anyone you know) are thinking of buying or selling, or you simply have questions, please don't hesitate to reach out. I'd love to help! While the average sales price of a home in the area has dropped a bit from its high of $399,990 (June '23) to $390,000, it's by no means a large drop and tracks pretty well with seasonal trends. August always dips a little in numbers simply because the heat, vacations, back to school, etc., generally cause the market to take a bit of a breath before "back to business" in the fall. That average sales price number is up from $380,000 this time last year, so if the national media has told you things are cooling in some areas, we are not one of them that is. One bright spot in the housing affordability stress is that while our prices have gone up, they do not (generally speaking) appreciate the insane rates that some parts of the country has, and that's definitely welcome if you're buying. We're definitely still feeling the inventory shortage, with closed sales for August totaling 1140, vs last year's 1507. We still do not have enough homes to sell, despite the interest rate increases sidelining some of the people who would have liked to buy. As a result of this inventory crunch, we're still seeing homes sell for 102.3% of the list price, generally due to multiple offer situations. This is down only ever so slightly from last August when it was 102.5%. Sort of crazy when you do consider the 100% increase in rates since then. In fact, neither the days on the market until a home sells nor the number of showings until a contract has been received, has changed at all since last year. So when will this get better? It's going to get better, right?? The good news is yes, it will. The bad news? We're not sure when, or how much. Given that we were already in an inventory shortage prior to the rate increases, that's gotten considerably worse. According to Redfin data, 66% of homeowners in Virginia have rates below 4% (and 28% have rates under 3%). That means that for many of them, they'd nearly double their rate by selling and buying another home. There are always reasons that will make people need or want to do this, but the casual "I'd just like a new home," sellers/buyers are in most cases sitting this market out. If you're thinking of buying, you may be tempted to wait until rates drop, and I totally understand. Just don't think that prices will drop at the same time. With the inventory shortage likely to continue into the foreseeable future (most experts say that nationwide it may take a decade for our housing shortage to catch up), prices are likely to continue to go up. If rates drop a good bit, the prices are likely to go up even more. (That's just Econ 101- low supply will push demand higher). According to many experts (those experts again!), including Fannie Mae, rates are likely to drop to around 6% or so in 2024, but probably not until the second quarter. They're very unlikely to drop this year, though, so the market this fall is going to be... well, interesting. Historically, rates hover around 5-6% and that's certainly likely again, but please please please don't continue paying rent, and waiting for those 3% rates again. They will most likely never return. If you have questions about any aspect of the real estate market, I'm happy to help. Just drop a comment, send me a message, or give me a call! *All numbers and stats here are from info found in the Central Virginia Regional MLS, and based on numbers for the Richmond Metro area.

Read more

As the summer winds down (a bit at least), the market has not changed a whole lot from the last couple of months. Inventory is still tight, leading us to remain in a solid buyers' market. Check out the graphic here for a little snapshot of what's going on, and how it compares to the past few months. Listing inventory has actually been dropping consistently over the past few months, and is nearly half of what it was this time last year (which was already a low inventory point for our market.) As rates have risen, there is definitely less motivation for homeowners to sell, as many have refinanced to very low rates in the past few years. Until this situation improves, our inventory is unlikely to grow by much. That means, if you are thinking of selling, it's still a great time. Despite interest rates, there are still lots of buyers out there, and terms for sellers are more easily negotiated (not only price but repairs required, closing dates, etc) right now. If you're buying, yes, rates are not terrific, and inventory is low. However, if buying is something you want or need to do, all hope is not lost. We have found our clients a number of homes off the market in the past year, putting them in better positions to not have to compete and find the home they love, so that is always an option. When you're working with me as your buyer's agent, my goal is to do all I can to get you where you want to be. In better news, most experts predict rates to begin to move on a downward trend through 2024, as long as the inflation numbers continue to look good. That's a glimmer of hope. Just remember, as rates drop, prices and competition, are likely to increase. Not a whole lot of things in life are guaranteed, but the rules of supply and demand are. If you want to know what all of this means in terms of your personal situation, give me a call, and let's chat!

Read more

Somehow, it looks like the year has managed to get to the halfway mark, so it's an even better time than normal to check in and see what the real estate market in Richmond is doing. After the past few very unprecedented years, I know everyone was hoping that this would be a more normal year. Alas, circumstances had a different idea, and it's still a very unprecedented market. Last year, we heard lots of folks predicting a crash. Values would drop, and we'd maybe even have another situation on our hands that looked like '07 and '08. Yikes. That sure didn't happen. So where are we now, as we begin the second half of 2023, and more importantly, what does this mean for you? Some general statistics: The average sales price of homes in the Metro Richmond area was $470,585 in June. Average sales price in June of 2022 was $434,35, and in 2021, $376,599.Yes, contrary to a lot of the news predictions, prices are continuing to go up. But wait a minute! Why? There are a few reasons. We've been struggling with a nationwide housing shortage for a few years now. After the mortgage crisis of '07-'08, lots of builders stopped building, and between that lag in production and a whole new generation of homebuyers dropping into the market, the supply has just not come close to catching up to demand. To compound that already low inventory, rates have made the inventory issue much worse. According to Redfin, 60% of homeowners have been in their homes for less than 4 years, and nearly 92% of homeowners have mortgage rates below 6%. That means many of them are not ready to move at all, and even those who are are surely struggling with the idea of trading a 4.5% mortgage rate for one that's been hovering around 7% for a while now. None of that is particularly great news, if you're buying, I know. Inventory is tight, and rates are not particularly good. However, my thought is always that if it's otherwise the right time for you to make a move, some of those market conditions just have to be part of the equation, rather than the whole determining issue. Remember, rates will likely go down (depending on who you ask, probably sooner rather than later) and when they do, you can certainly refinance. Unfortunately, they're unlikely to go as low as pandemic levels, as that was likely (we hope!) a once in a lifetime anomaly in a number of ways. What we do know is that when rates go down, more buyers will enter the market, and that will make the competition tighter. All that to say, if you're buying, or wanting to buy, don't wait for some magical date where rates will go lower and prices will be better, because those things are very, very unlikely to ever happen at the same time. More likely- the longer you wait, they more likely prices are to continue to rise. Don't get in over your head- make sure you can afford the house that works for you at the rates as they are, and remember, whether you're a first time buyer or moving to a home that works better for you for whatever reason- it doesn't have to be the "forever home" that leaves you financially strapped every month. But what if you're selling? It should be a snap, right? Just throw a sign in the yard! With 10 buyers for every home, that's a no brainer. Right? Yes. Well, kind of, and also no. In June, we dropped back down to 1 month of supply (a balanced market is 6 months), so it is undoubtedly a great time to sell. The demand is there, for sure. If it's been a while since you've sold a home, the market is different. Buyers are different. And, the amount of information buyers have access to is different. That means, yes, you can probably sell pretty much anything in this market, but for how much, and how long will it take (and at what cost?) Getting your home ready to sell matters in this market, if you want to get "top dollar." That means making necessary repairs, cleaning and decluttering, and in many cases, staging as well. Pricing the home well, and marketing it professionally also play a huge role in being able to get the most out of your equity. If you're thinking of selling, don't just "throw it on the market." Even in this market, you'll definitely find yourself in a much better position if you work with a professional who can help you maximize the value of your home. Regardless of whether you're thinking of buying or selling, homes are indeed back to selling over the asking price in many cases (our average list to sale price percentage right now is 103.5%), and that means tougher competition for buyers, and better money and terms for the sellers. (And if you're both buyer and seller? Plan accordingly.) Looking for more detailed info about your neighborhood, house, or an area you want to move? Give me a call! I'd love to help!

Read more

Summer is here, and that normally means a dip in activity for the real estate market, but over the last few years, "normally" is a term that we've all sort of tossed out the window. (I'm sure you know what I mean.) If you're wondering where we are in the Metro Richmond market, here's a little snapshot of what's going on right now, as we dive into summer... As of the end of May, the average home's sales price was $455,408. For a little perspective, that's up from $428,999 in April of this year, and $435,893 in May of 2022. This despite the fact that interest rates are up by over a full percentage point year over year, and of course, lots of predictions that home values would tank. Those predictions didn't amount to much, since the tight market of the last few years has, in fact, just gotten tighter. Why? There are a few reasons- we are in a legitimate housing shortage, as many builders either stopped or slowed building any type of housing units after the bust of '07-'08, whole new buying pool has dropped into the market in the past few years, and with interest rates rising, there are loads of people sitting in their home with a 3% rate not even thinking about selling and having to buy at more than double that rate. Ugh. I know. Frustrating (to say the least) turn of events! That shortage of inventory means that while last year (2022) seemed like the craziest ever with homes selling on average at 107% of the asking price, we've only dropped down to 104% a year later, with much higher interest rates. The average days on market in the Metro Richmond market is only slightly higher than a year ago. In May '22, homes were on the market for 12 days, and now it's 17. But remember, that's the AVERAGE. The median is exactly the same, at 6 days. My thought, though, is that that is a muddy data point. Many homes lately are going on the market with delayed showings, often going on the market on Wednesday, with showings starting Thursday, and offers being reviewed on Monday or so (or some combination of similar days). In other words, "sold in one day!" is often not happening, as showings run for a set number of days, with a deadline for offers. What does all this mean for you? At the risk of repeating myself, if you're thinking of selling, it's still a great time. With so few homes on the market, your odds of selling very quickly are great. And while you'll definitely maximize what you get for your home if you do some work like staging, painting, and repairs, you'll likely still be able to sell easily even if you don't have the time or money to do those things. (So if you have a house you've been wanting to sell, but don't want to "put the work in" to get it done, NOW is a great time to put it on the market!) If you're looking to buy, this is a market where having a great buyer's agent can really put you ahead of the pack. There are lots of ways to "win" a home in a competitive situation without giving away all of your money and peace of mind, but it definitely takes planning and strategy right now. If you're thinking of buying or selling in this market (or anytime), I'd love to help you get where you want to be. Let's talk! *Information here is based on numbers from ShowingTime/Market Stats, and CVRMLS **Numbers are for the Metro Richmond area only

Read more

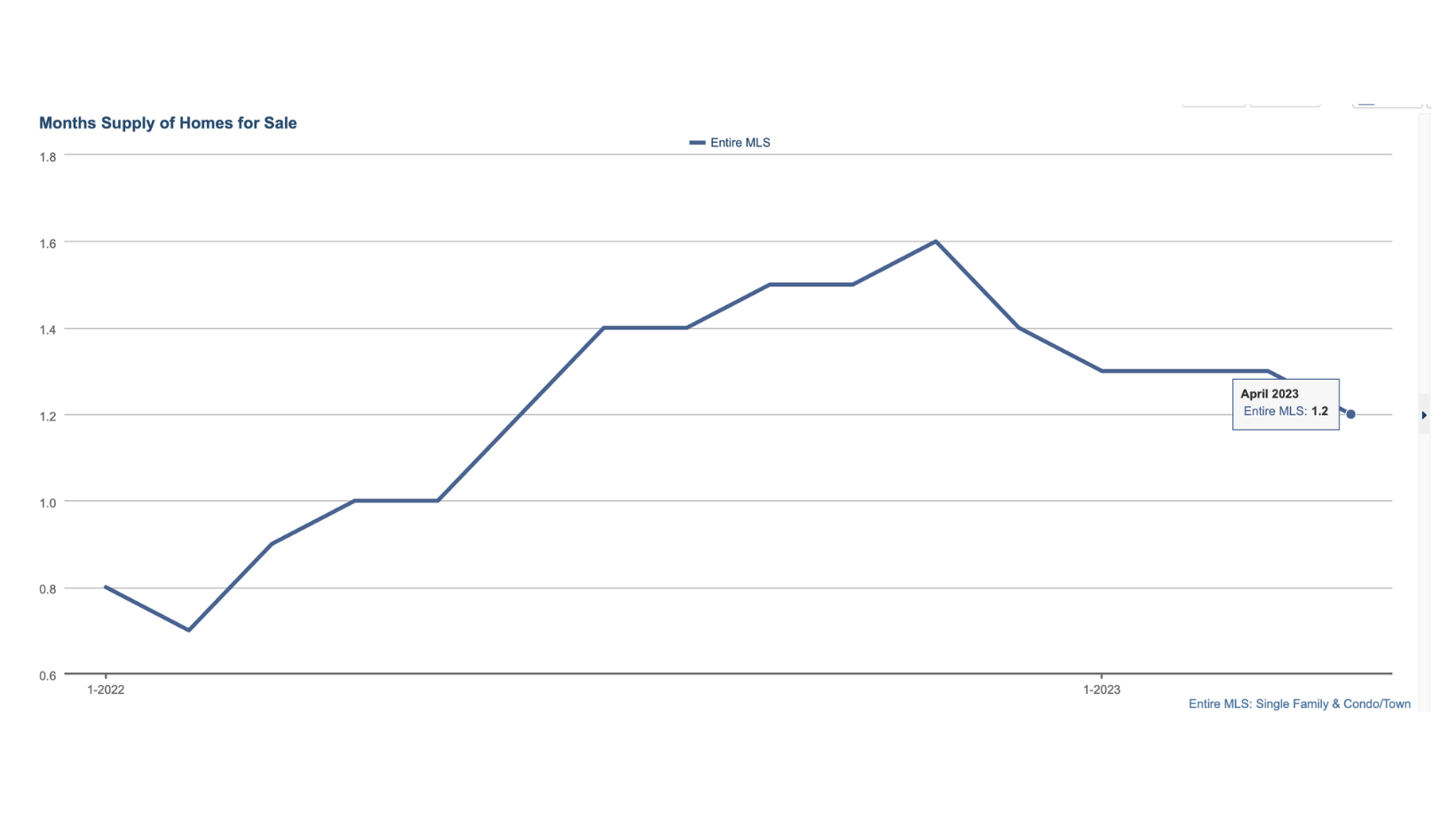

Well, spring is in full swing now, and April showers may have brought flowers, but they certainly didn't bring lots of real estate inventory. Things are still moving quickly, so here's a bit of a recap: The average sales price for our entire MLS area was $402,414 in April. That's up from $403,244 last April, and a good jump from March of this year at $386,797. The price stability and increases really are largely due to the lack of supply in the market. Rates have certainly risen since last year, but for the most part, it hasn't pushed many people out of the market. Our inventory as April closed out stood at 1933 homes for sale, down from 2203 in March, and down from 2022 in April of last year. Supply is just not where we need it to be (frankly, in either rentals or sales) and the demand is definitely out there. As I've said before, the market is considered to be balanced at 6 months supply of inventory, and while we're definitely better than we have been (February '22 had us as low as .7 month), we are still only at 1.2 months. That means that if no other homes came on the market, it would take 1.2 months for the supply to be exhausted. That's not much. What does this all mean for you if you're looking to sell? What about buying? Is it just a crazy time to do that?? These questions are both so unique to your own situation, I always hesitate saying, "it's a great/bad time to sell/buy," to a degree, regardless of the market. What I can say, though, is that if you've been contemplating selling and you thought the market was going to drop as rates went up, that hasn't proven to be true. In most areas, we are still very decidedly in a seller's market, so no doubt that it's a good time to sell. If you're thinking of buying, and it's a great time for you otherwise- new job, lease is up, new baby, new job...whatever, it's not a terrible time to buy- prices do not have the same upward pressure that they had a year ago. Yes, we're seeing multiple offer scenarios, but not every house, not every time, and often not as insane as the offers were last spring. We are seeing more inspections, more appraisals, and a bit more negotiations on some homes. But, it's not the time to drag your feet if you're looking. It's a good time to really know what your negotiables and must haves are, and work with an agent with a solid grasp on the market (like me) that will tell you what they think will get the home you want, rather than just guessing. Keep in mind, too, that there is no perfect market. If rates are lower, prices will be higher, and vice versa. It's nearly impossible to time the market, too. So if it's a good time FOR YOU, it's probably a good time. If you have questions about buying or selling in this market, reach out. I'd love to talk to you and help you determine if it's a great time for YOU.

Read more

Well, the spring weather may be popping its head up here and there, but the spring market is definitely here! If you're wondering what the market is doing here in the Richmond and surrounding areas, here's a little breakdown, piece by piece... Price- We're always hearing lots of talk about prices here, there, and everywhere. But what are prices in Central Virginia actually doing? The median home price in our entire MLS (which covers a fairly broad area) closed out at $344,900 for March '23, only a bit over $3000 higher than March of '22, and down from a high of $363,000 back in May and June of last year. The average home price was $383,036, and that's an even more narrow difference year over year. Inventory- So year over year, our prices have crept up just a bit, but maintained very well. If you're thinking, "why?? I thought the media kept saying the market was going to crash," the answer is fairly simply supply and demand. Last March, there were 2445 new listings that came on the market. This year? Only 1929. That means close to 1/3 fewer homes from which to choose, and the buying pool has not decreased by nearly that much. If you've been following real estate, or the overall economy, in the last few years, you likely know that there are simply not enough housing units (single family, condos, apartments...you name it.) to satisfy the need of people who need a home. By and large, that's because builders just stopped building, went out of business, etc, during the mortgage crisis of 2007-'08. And while the buying and renting pool has continued to increase, they've simply never caught up. Also, over the past few years when rates have been between 2.5%-3.5%, nearly everyone refinanced or bought. Most of them are not likely to put their homes on the market if they don't need to. To go from 3% to 6% is just a jump a lot of people are not interested in making. Demand- There's no way at all for us to tell how many buyers are actually in the market, per listing, but we can tell that last year this time, the "average" home was getting 16 showings before it went under contract, and this year? That number has shrunk to only 12 showings this March. That seems to indicate that there is a greater demand in the market. Okay, so, prices are stable and rising in the area...what does that mean for you if you're buying or selling? Well, if you're selling, that's a pretty easy answer. It's definitely a great time to sell. If you thought you missed the "hot" market of the last 2 years, you didn't. It's still a great time to get top dollar for your home. What has changed, though, is that in many ways, homes are costing buyers more, therefore, the buyers are not as keen to do as much as they may be in another market. In other words, making sure your home looks "ready for prime time" and is in great shape can make all the difference to get to that multiple offer situation that allows you to pick the best offer with the best terms for YOU. If you're buying? There are opportunities out there, but they are sort of few and far between. Be open to options that may not be "perfect perfect," but that allow you to add equity and value over time. Think ugly wallpaper, kitchen that needs some love, or functional bathrooms that need a makeover. Yes, those things will cost you money, but may put you in the position to have little to no competition (maybe even get a bit of a deal!), and recoup some great appreciation and possibly a better appraisal and refinance at a lower rate should rates go down later. If you're determined to buy that home that everyone wants, be prepared to compete. That means having all your proverbial ducks in a row- reapproval letter from a lender, contingency plans regarding inspection or possible repairs needed in the event you cannot have a full inspection, and the ability to be flexible on terms to appeal to some of the sellers' non monetary goals... Oh, and make sure you've got some extra intestinal fortitude, as it can be a real roller coaster ride. It is worth it in the end, though, to get a home you love! What questions about the market in your area or neighborhood can I answer for you?

Read moreIt's hard to watch or listen to the news on any platform lately without getting some sort of news on the housing market. To hear the national news, things have cooled tremendously, but we all know that real estate is really local, right? The story around here is, more or less, a simple tale of supply and demand. A six month supply of housing units is widely considered to be a balanced market (neither buyer nor seller’s market), and we are still in a market with only just over 1 month’s supply. That means the simple concept of supply and demand is going to keep prices steady for a while, and in many pockets of our market, keep things competitive. (For perspective, in February of 2022, the inventory low- we had only .7 months.) For the same sort of perspective, in February or 2022, we only had 1544 active listings in our MLS, and this February, we closed out with 1792. That’s just not that big of a jump, and the buyers are still out there. In fact, homes last year this time were selling on average for close to 107% of listing price, but this year, they are still selling at nearly 98%. (And that’s an average. The median list price to closing price percentage is sitting at 100%) Last January, the average sales price of a home in the area was $378,029. This January, that price is up to $388,060. Yes, that’s up, for sure, but it’s important to note that the average price in May 2022 was $435,893. Does that mean the market has dropped/cooled/changed? Well, sort of. Things have definitely been flattening out from the wild spikes of the last couple of years, and if you were hoping to get on the market and garner 20 cash offers with huge escalations and no inspections, you may well have missed that boat. However, despite what you hear on the national news, our market is in a much softer correcting cycle than many in the country. Anecdotally, we have seen more and more buyers be able to have home inspections, appraisals, etc, over the last few months. That's been a very welcome change for the buyers out there, and we are still seeing them, but perhaps to a lesser degree at the moment. As we head into spring, and the spring market, we're definitely seeing more of those multiple offers, and more situations where those things are being waived again. In short, while rates have definitely gone up, there are still lots of buyers out there looking for homes, and just not enough homes out there for them. While we do anticipate that inventory loosening up a bit as the weather warms, we definitely need more listings! If you're thinking of selling, it's definitely a great time. And if you're thinking of buying, we can get you where you want to be! What will it take? Just a little bit of planning, a little creative/out of the box thinking, and yes- patience. If you have questions about the market, or just your little section of it, reach out! I'd love to break down the data that matters for YOU. *Graph and data- MarketStats by ShowingTime

Read more

It's January 2023 and I'm here to give you the scoop on the Richmond area real estate market for this coming year. Have questions? DM me on Instagram @cindybennettrealestate or at my website at cindybennett.net

Read more

In my latest Real Talk with Cindy, I sit down with Josh Crowley at Liberty Mortgage. We discuss mortgage options in today's changing market, pre-approvals, seller concessions, and first-time buyer tips. It's a conversation you don't want to miss. Have more questions? We'd love to help. Reach out to me on Instagram @cindybenettrealestate or via my website at cindybennett.net or Josh at Liberty Mortgage at 757-784-7269.

Read more

Whether you own a home, want to own a home, want to sell a home, or just like to keep up with the news, you've probably been hearing plenty about the real estate market, interest rates, and all the attendant chatter. To misquote a quote, the rumors of a crash have been greatly exaggerated. Here in the Metro Richmond Market, where I also pull my numbers unless stated otherwise, we've definitely seen a shift- anecdotally as we've seen more inspections granted, fewer multiple offer situations, and more negotiation on the part of buyers (cue sound of buyers rejoicing everywhere). By the numbers, we see basically the same thing, but you sort of have to look a bit closer to really see what's going on. In November, the average sale price of homes in the Richmond Metro area dipped to $421,017 from $423,438. Not a huge drop at all. BUT, if you look at the median, you'll see that the median sales prices has actually been totally flat since August at $365,000. In addition, while the median list price to sales price ratio has been flat at 100% since September, the average has dipped to 99.9%. That's no kind of crash. A leveling, or an adjustment for sure. But considering that the high of April 22 was 107.5%, that is a drop indeed. Basically, you're still not "stealing" a house here in the Richmond area, but if you were looking over the last 6 months and got tired of crazy multiple offer situations. those have largely dissipated. While we may see some *great* homes that have multiple offers, most homes now do not. Can you get homes with an inspection and/or negotiate a price reduction or some concessions? You absolutely can! It's happening pretty consistently, in fact. If you're selling, 100% of list price still doesn't sound too bad, does it? Just make sure you have an agent you trust to help walk you through the process, from prep, to pricing. Do you have more questions on the market? I'd love to help!

Read more