Real Estate Market Updates

Pretty self explanatory, right? The market is always changing, and remember, markets are very local! This is where you’ll discover the up to the moment info on the housing market in the Richmond area. Got deeper, or more specific questions? Send me a message or give me a call!

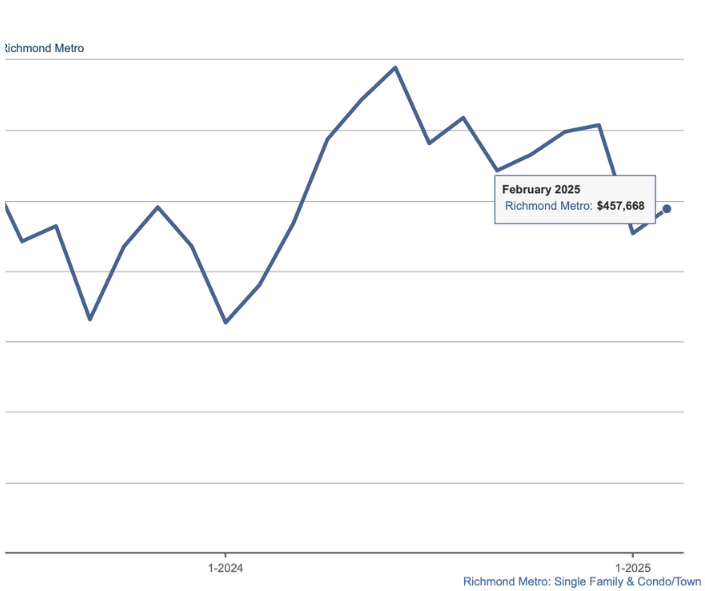

Despite much of the national news being less than great, the market in the Richmond area is doing just fine. Here are a few highlights. Prices: Our average list to sold percentage is right at 100% now, and that's pretty good, whether you are buying or selling. Last year this time, that number was 104%. While no one is getting a "deal" in this market, we're also not seeing the whole market paying way over list price for homes on the regular. If you're selling, homes are still moving, and we're definitely still seeing the "market ready" homes going for at or above list price. (Saying this with the caveat that there are plenty of homes that don't sell for top dollar, but they are generally not in great condition, or they're not priced well.) Inspections: If you're buying, there is great news, and that's that inspections are fully, completely, BACK! While we are seeing some waivers of smaller items, etc, we're seeing inspections much more as the rule rather than the exception, and that's great for buyers. If you know you're in a competitive situation, think about how you can make that inspection clause more appealing to the seller. (There are a lot of ways to do this while still covering yourself against major issues.) Inventory: Inventory is still rather low. Going back to the old standard of the month's supply, we're at 1.8 months of supply of homes right now (a balanced market is 6 months). That's exactly where we were with inventory this time last year. If you're thinking of buying, the good news there is that the inventory is more or less holding steady. The bad news is that if you have been on the fence about buying, and waiting for rates and/or prices to go down, that's unlikely. The average sale price in our entire listing area (including Richmond and all of the surrounding counties) is just over $450,000, as of March 2025. Last March, that number was $432,000. Not a huge jump, really, but definitely going up. What questions do you have on the market? As always, every home, every neighborhood, every area is somewhat different. If you have questions about your home, or your dream home, reach out! I'd love to break down the market for you and your unique needs and goals.

Read more

Market updates are a bit like tapping the mic with an "is this thing on?" People say they want them, but I always wonder how much they actually get read. So if you're reading this, please let me know! March 20 heralds the first day of Spring, and I for one couldn't be more excited. But if we're talking about the market, it really has felt like spring for a while now! Here's a little bit of data to give you a snapshot of the overall market in the Richmond Metro. The average sales price in the Richmond Metro in February was $476,907. That's a bit lower than the prices in December, but a bounce back from a lower January price of $469,296, and it looks like it's back on the upward trend. If you've followed me for a little bit, you've probably heard me talk about the months supply, and how at a balanced market, we'd have about 6 months of inventory. It's been a while since we've been there, and for the last 2 months, we're holding strong at 1.3 months of inventory. A good distance from balance. This data tracks in what I've seen in the last couple of weeks, as well. Lower inventory means you may need to compete to get that home you love, because there are simply more buyers than there are great houses. Sometimes that means you have to pay more, but sometimes it just means having as much info as you need to craft an offer that will be the most appealing to the seller. Every situation is a little different, so there really is no one size all formula here. If you're selling, lower inventory means you have more eyeballs on your house, usually more showings, and (in many cases) more offers. Yes. You only need one offer, but the nice thing about multiple offers for you as a seller is that when people are competing, you're less likely to have to deal with a lot of inspection issues, you usually get more money, and you are more in the driver's seat with the entire transaction. We're seeing lots of multiple offer situations, although the market is quite price sensitive. What does that mean? You can't just thrown any home on the market, at any price, and think it's going to sell. The homes that are not "market ready" are still sitting on the market, and generally not getting multiple offers. Having your home ready makes a huge difference, as does pricing it well. Price it too high, and it just might sit there as well. There are definitely neighborhoods and areas that are more popular, and others where things are not quite as "wild." Knowing which one you're in, or looking in, can make a huge difference. I'd love to talk to you about the area you're in (or want to be in) and help you determine the best strategy to get you where you want to be. What are your market questions? Reach out!

Read more

January has historically been a veeeery slow month, but for the past few years? Not so much. If you're thinking about selling, and thinking you'll need to wait for spring, you really don't, these days. If you're ready, the market is likely ready for you. As you have probably seen me say before, a balanced market is about 6 months of inventory. That means if no other homes come on the market, it would take 6 months to sell through all of the homes on the market with the current population of buyers. It's been a minute since we've been there. We went as low as .7 months over the pandemic, but for the last couple of years, it's gone up a little, bit by bit. As we head into 2025, our market sits at still a pretty seller friendly 1.7 months. Pretty crazy for January. (And it used to be unheard of.) Anecdotally, over the past month (including the week of Christmas) had multiple clients in multiple offer situations, on both sides of the equation. You're probably thinking, "This same old song again? When will this ever change?" and you're not wrong. However, there are a couple of caveats to this sellers market, for those buying, AND yes, even for those selling. First of all, if you're selling- If you've been watching the market, or maybe watching your neighbors, you may want to price your home at the final sales price of the neighbor's home. But wait- as hard as it often is to believe, you will likely get more money at the end if you price it right at (or even just under) the price the market and the comparables show. This of course is a little bit less simple, and a little more nuanced, than that, but I cannot say enough how important pricing is. Over the past few months, the market has dipped just a bit for homes to sell right at 100% of the asking price. (On average.) Keep in mind that that 100% is an average, but that also, if the sales price is reduced, and the seller gets that price, it's still 100%. Get your house ready. I mean, really ready. That means declutter, make those small repairs you need, refresh lighting, paint, landscaping, etc, if you need to, and clean, clean, clean. (And clean some more!) While there are lots of homes selling quickly (with a median days on market of 17), and for multiple offers, even, generally speaking, these homes are usually the ones that are priced well, and show really well. If they're not both, they need to be really heavily one or the other. If you're buying: DON'T get discouraged before you start! (I mean, don't get discouraged after you start, either.) I really, truly believe that "the one" is yours in the right timing. In truth, I also believe that there is not usually just "one" out there for you. Get prepared and stay prepared. That means have a lender (preferably a local lender!) run all of the scenarios that might work for you- downpayment, closing costs, payment amount, and special programs. If you need a gift of funds and a gift letter, make sure you know how that works, and what the lender requires. Get a reapproval letter from them, and make sure that you'll be able to reach them if you need a last minute change that's property specific. Understand your responsibility in the "new world" of buyer agency- that means when you're working with a buyer's agent, you may be responsible for paying your agent's commission. In most cases, the seller expects to pay all or some of it (remember- most comparables still include some, often all, of both the buyer's agent commission as well as the listing agent commission). In the occasions that we cannot include it, we can often adjust the price accordingly. Every now and then, though, you the buyer may be expected to pay that out of pocket. Don't forget to factor that in. Once you know your numbers, start looking, and be reasonable when you write an offer. Get familiar with the market and the comparables, and listen to your agent! Unfortunately, it's still not the market to get a deal in, but that doesn't mean you have to waive everything and go crazy, either. Inspections are so back, and I'm so excited! There were definitely a few years there where we were seeing people waive inspections with regularity, and now, we are seeing more inspections, repairs, and credits for repairs again. We are still seeing multiple offers, but not in the insane numbers we were. That means you may still have to compete, but usually only against a few people- not 25. That means that while the offers may go over, they're probably not as crazy as they once were. Inventory is still low, but I'm seeing more hope out there for buyers than I have for a while. If you're curious about buying, call me. I'd love to help you determine if it's the right time for you. If you're thinking of selling, don't think you have to wait until spring. The buyers are out there now, and if you need to do anything to your home to get it ready (and most people do) the time to get started on that is now!

Read more

Welp, I know you may have thought things will be slowing down a bit more than they seem to be. That may be good, and it may be bad, depending which side of things you are on. But let's break it down by the actual numbers. Current Market Overview: As of November 2024, the real estate market in the Richmond, VA metro area—including the City of Richmond, Chesterfield County, Hanover County, and Henrico County—is still experiencing robust activity characterized by rising home prices and fairly swift sales, despite the time of year being one that is historically quite slow. Current Market Overview: Median Home Prices: As October 2024, the median listing price for homes in the Richmond metro area was $395,000, reflecting an 8.2% increase compared to the previous year. That has leveled out just a bit as we near the holidays, but our market is still showing good appreciation as we near Thanksgiving. Average Days on Market: Homes are selling fairly quickly, with an average of 37 days on the market as of October 2024 and only a slight increase now that we are in November. Market Competitiveness: The market remained quite competitive, with many properties receiving multiple offers and selling at or above the listing price. It is important to remember that that this data shows as the percentage of sales price to list price. (Therefore, it does not include data on price reductions, which often happen prior to a successful sale when a home has been on the market for a bit.) Market Trends: Inventory Levels: The number of homes available for sale is still limited, contributing to the competitive environment. Zillow notes that as of September 30, 2024, there were 2,917 homes listed for sale in the Richmond metro area. For some perspective, at the height of the pandemic, in 2022, we were all the way down to 910 homes for sale. Crazy! In fact, you may have heard me talk of the absorption rate, otherwise known as the "months supply of homes." That means that if no other homes came on the market, it would take __ months to sell through the homes out there now, based on buyer demand. In a balanced market, the months supply should be somewhere in the neighborhood of 6. While we have been as low as .60 in the last few years, we are now firmly parked right around 2. Not balanced, but much better than it has been. Price Appreciation: Home values have appreciated steadily. Zillow reports a 4.2% increase in average home values over the past year, bringing the typical home value to $366,897. Sale-to-List Price Ratio: Homes are selling close to their listing prices, with a median sale-to-list price ratio of 100% in October 2024, indicating that properties are generally selling for their asking prices. (Again, this does not included the homes that dropped their prices before selling.) What are the Predictions for 2025?: Home Prices: The upward trend in home prices is expected to continue into 2025, albeit at a potentially slower pace due to factors such as rising mortgage rates and economic conditions. Market Activity: The market is likely to remain competitive, with demand still outpacing supply. However, if new construction increases or more homeowners decide to sell, inventory levels could rise, potentially easing competition, which will obviously stabilize/keep prices a bit lower. Days on Market: Homes are expected to continue selling quickly, though the average days on market will lightly increase slightly if inventory grows or buyer demand moderates. Conclusion: I truly am starting to feel like a broken record, but it's all based on the data. If you're thinking of buying, you should be prepared for a fast paced market, and sellers should expect favorable conditions to sell, if their property is priced properly for the condition, location, and market. Are you thinking of buying or selling and want more detailed, customized information? I'm always happy to help. Just reach out!

Read more

The Richmond Metro housing market in September 2024 presented a mixed picture, with some segments showing strength while others hinted at possible easing. Single-family homes continued to be in high demand, driving price growth. New listings were up slightly (2.3% year-over-year), while pending sales increased significantly (15.2%). Closed sales dipped just slightly (1.2%). This suggests a slight cooling in the rapid pace of sales seen previously. The median sales price jumped 8.1% to $425,000, and the average sales price increased 8% to $483,405. Homes also took a little longer to sell, with days on market increasing 25% to 25 days (on average.) The condo/townhome market showed more signs of shifting towards a more balanced market. New listings surged 12.2%, and pending sales were up 21% year-over-year. However, closed sales dropped dramatically (20.1%), and inventory levels increased (up 14.7% from September 2023). Months of supply also rose from 1.9 to 2.1 months. Prices, however, continued to climb, with the median sales price rising 9.5% to $387,000 and the average sales price increasing 14.8% to $406,064. Overall, the Richmond Metro market remains strong, but things have cooled just a bit in past couple of months. Anecdotally, we've definitely seen an uptick in price reductions across the market. As I've been tracking this for the past 6-8 months, we went from pretty consistently 250 or so reductions per week, until around 3 months ago when that number increased to around 350. So, when you see the data that most homes are still selling for around 100% of their asking price, that's true, but it does not factor in the price reductions that the listing may have seen. While I would by no means say our market has cooled, and I certainly wouldn't call it a "buyers' market," we are definitely seeing a less frenetic pace of sales, and overall, fewer offers on listings. More inventory (or at least a little more) and as a result, less competition. So, if you're thinking of buying and you've been on the fence about jumping into the market, it's a good time. If you're selling? Well, it's still a good time, but if you're wanting an offer of way over asking, with no inspection, and no appraisal, you may find yourself disappointed if you're starting at an "early summer" price. Price it more reasonably, and make sure you're showing off all the best features of your home, and you'll be much, much happier with the outcome. Do you have questions on your home, your neighborhood, or area? Reach out to me. I'd love to help you determine if it's a good time to make a move, and help you get where you want to be! Click HERE to look at all the numbers used to make up this assessment.

Read more

As we enter into the fall season, things are picking up again from the slightly more sluggish market of August. (And is there a better word for just about anything in August than "sluggish?") Almost every year, we see a bit of a dip in August, and a pick up after Labor Day, after vacations are over, kids are back to school, and people are a little more "back to business." Over the past few years, this cycle is a little less reliable as things have been in a nearly nonstop upward trajectory. In August, the month's supply of homes for sale stayed the same as it was in July, at just under 2 months, and it's the highest it's been since October of '23. Now, we're still not near a balanced market (that's closer to 6 months of inventory), but it's definitely better than it has been. Overwhelmingly, we're still seeing homes that are "done" are selling quickly, and we're still seeing plenty of homes sell for over asking price. The homes that are not "done," or are not priced accordingly, are sitting for much longer than they would have six months ago. Numbers are great, but easy to find and harder to unpack. Anecdotally, I've been tracking price reductions in our market since the beginning of the summer. What had been a pretty consistent 250 reductions per week at the beginning of the summer has been steadily creeping up, sticking at around 350 for weeks, and now tipping into the low 400's. Is that a terrible indicator? No. More likely it's a cooling of the crazy market that we've been in, where everyone wants to price higher than the last one, and not every home, nor every location, warrants that type or jet fueled appreciation. Additionally, when working with buyers, I've seen they have a bit more variety, and given that money has been and continues to be more expensive to borrow, they're a little more choosy about where they spend it on, meaning pricing is more important than it was even 5 or 6 months ago. As always, if you have questions about YOUR neighborhood, area, or home, or where you want to live, please reach out. I'm happy to break down the data that's specific to your situation.

Read more

The recent NAR settlement over commission has brought about some changes to the real estate industry. This has caused a lot of confusion over buyer's agency. Let's talk about the changes you may notice here in Central Virginia and nationwide. Have questions? Ready to talk real estate? Send me a message via Instagram at CindyBennettRealEstate or via my website www.cindybennett.net.

Read more

If you've been thinking of buying or selling a home, or you watch, read or listen to the news at all, you may have heard changes are coming to our industry this month. In fact, these changes take effect nationwide on 8/17, but will start to be put in place here in Central Virginia 8/6. So what are the changes, and how might they affect you? The who, what, and why... The biggest change is the "decoupling" of commissions. What the heck does that mean, anyway? For decades, real estate commissions have worked this way: An agent would list a home, negotiating and setting the commission with the seller, and a portion (usually half) of that commission would be paid from that listing brokerage to the buyers' agent and their brokerage. This year, a class action lawsuit filed against the National Association of Realtors and a few larger players in the industry, was settled. The suit was brought by some home sellers who felt that they had not had any choice to negotiate or change what they were paying to the agent who brought the buyer for their home. As a major part of this settlement, the National Association of Realtors agreed to change the way buyers' agent commissions were paid- "decoupling" them from the commissions negotiated by the listing agent and the seller. Forever (at least during the 21 years I've been in real estate), agents have been able to see the buyer's agent commission that is being offered on a particular home in the MLS (multiple listing service.) Effective 8/6 here in Central Virginia, that will no longer be the case. It's not that commission won't be offered. In some cases it will, and in some, it may not. It just cannot be visible in the MLS anymore, effective August 6, 2024. Now, having said all of that (which I hope makes sense) Here's how it might affect you: Before you are able to view a single home, you will need to sign a buyer brokerage agreement with an agent. This is a change for many people. While buyer brokerage agreements have been "a thing" in Virginia for years, to say that it was a loosely enforced rule is an understatement. This agreement lays out what the agent is going to do, what you are obligated to do, and hopefully, brings some clarity to how and what we get paid in the process of your home purchase. This fee is, and always has been, negotiable, and there are a variety of options available in the market. It also states quite clearly that you, the buyer, are committing to pay this agent you're retaining at the end of the transaction. Somehow, and in some way. HUH? When you decide you want to purchase a home, you should have a "buyer's consultation" with the agent you are thinking of working with. You may even interview more than one. That agent(s) should review not only the buyer brokerage agreement, but also how they work, what they're going to do for you, and give you clarity on what they charge for their services. This is not new. (For me, at least.) Here's the NEW part. Previously, as these agreements were only loosely enforced, and in many cases, signed only after you might be under contract, most buyers didn't understand that they were liable for that buyer's agent commission if the seller/listing broker was not paying it. It was also often written to read "buyer's agent accepts whatever is offered in MLS," so buyers' agents didn't always have to have those icky money conversations with their clients, because they could clearly see the commission on every house in MLS. So how is this NEW?? The new agreement does not have that option, as there will be no commission listed in MLS. The commission must be discussed and agreed upon before any home is shown. Because while commission has been "paid by the seller" for years, we all know the seller is not paying anyone anything until the buyer actually buys the home. So who's really paying? Yep. The buyer. (So yes, it seems like it's changed, but in many ways, for many people, it won't make much of a difference.) Agents will not be able to show preference (in theory, at least) to homes that are offering higher commission. I've never done this, but I'm sure it's done. Does this mean I'm going to have to pay my agent if I'm buying a home?? Maybe. In most, or at least many, cases, there will be all or some commission still offered by either the listing brokerage (as has always been the case) or the seller. This may be offered in the form of a straight payment of commission, or might be negotiated in the offer in the form of closing costs that you can use to pay your agent. In the event the seller is paying less than you've agreed upon with your agent, you will have the option to either make up the difference or ask the seller (in your offer) to pay more than they've initially stated, either directly, or to you through concessions (closing costs). If the news, etc, has led you to believe that if you are selling, you no longer have to pay a buyers' agent, that's both true and not true. The truth is, even before this, you could have offered as little as $1 to the buyers' agent, so technically, you never "had to" pay a buyers' agent. Is that a good idea? Well, It's probably not the best way to get the most people into your home, because IF people are working with a buyers' agent, which most still will be, they will have to pay their agent out of pocket if you are not. That means, if they don't have the cash to do so, they may have to pass on seeing your home. What if you don't have the money to pay your agent and the seller won't contribute/help?? Unfortunately, this will likely be a problem in some circumstances, and one of the concerns I have about the whole situation, especially for first time or low cash buyers. If a seller refuses to contribute, we can always ask them to increase the price to allow for the concessions in the contract to cover your buyer's agent, but if not, if you cannot pay your agent, you may need to find another house. (This is definitely one reason why most sellers will likely offer some compensation). "Okay, so if I want to get the best deal on a house, should I just go to the listing agent directly, and represent myself?" Not so fast. There are a couple of things to remember here. First, and perhaps most importantly, the listing agent represents the seller, first and foremost. They are hired to get the seller the best and highest offer, with the best terms, for the seller. They have no duty to you, other than to be honest (not lie) and at best, facilitate. It's also good to be aware that the agent has likely made an agreement with the seller that in the event someone comes in with no representation, they'll make more money. So your savings, or the idea that you can offer less to the seller because they're saving money, may not even be a real thing, and you will have had no representation. "But can't they do dual agency, and represent both of us?" Weeeelllll, they can. It's legal. (For now) But think about it- they're working for the people who want the most money, and the best terms for them, and now they're going to also work for the people who want to pay the least amount of money? Hmmmm. (Oh, don't forget, this is not free, either.) Here's the thing: as a dual agent, the agent usually makes more money, but they now can't advise you, the buyer, OR the seller. What?? If that sounds crazy to you, join the club. Seems like the agent in this scenario is working for no one so much as themselves, right? That's exactly why I don't like it, and why I have never done it. Just want the high points with no yakity yak? 1- Buyers will need to sign a buyer brokerage agreement before they view any home. 2- As commissions are "decoupled," you as a buyer may have to pay your buyer's agent, as the seller may not always offer concessions in the amount you've agreed on with your agent. Make sure you understand what you've agreed to. 3- Yes, you can go to open houses without having a sign an agreement. (That only comes when you have a real conversation about the property.) 4- Sellers will still be able to offer compensation to buyer brokers, and in many/most cases, they will. My take? This will be a confusing, and likely slightly rocky, time, but change is often where good things happen. When it all shakes out, I do think it will be good for everyone- more clarity, more education, and better service for consumers. What questions do you have? Let me know.

Read more

The idea of the slow slow slow market of summer has changed over the past few years. Those cycles we could always count on like clockwork had already changed a bit, but the pandemic really wiped them off the map. That means that even though July is historically slow, now it's definitely less so, and there are fewer extreme peaks and dips seasonally. Soooo… that being said, here's what's going on in Metro Richmond real estate this summer. Despite the fact that rates have been bouncing around 7% for months (!), we're still seeing lots of sales and lots of activity. You may have heard me say that a balanced market is when we have 6 months of inventory, and it's been a while since we've been there. As of June, we are at 1.6 months. With the exception of a few months last fall, this is the most inventory we've had since before the pandemic- that's good news, especially if you're buying. More inventory means more choice, and less demand. In many cases, we're still seeing multiple offer situations, but generally that is on homes that are “DONE." (That means there are opportunities out there for buyers who don't have to have that perfect, brand new renovation!) What else does it mean? That if you're selling, the closer you can get your home to DONE, the more money you're likely to net, and that's good too. On average, we are still seeing homes selling in the Metro Richmond area for 100% of the list price, with no noticeable average deviation. That is based on the data available from our MLS. Anecdotally, though, I think those numbers are slightly skewed because I'm seeing many more price reductions (on average, our MLS is showing around 300 reductions per week for the whole of the summer so far.) That means that while the home may sell for 100% of the list price, it doesn't mean that it sold for 100% of the *original* list price. Again, those homes that are "show ready" are the ones that are selling for those higher prices. Want more customized information to your neighborhood, home, or where you want to call home? Let me know, and I can give you a personalized market report with projections.

Read more

So you're thinking of selling your home, but you don't quite understand how all of this commission conversation, agency conversation that's been in the news is going to affect you when you go to sell your home. Do you still pay a buyer's agent? Do you not pay a buyer's agent? What's the difference? Why should you do one and not the other? What's the benefit? What's the downside, and what the heck does all of it mean? I want to break down some of these conversations that you might be seeing in the news. There is a lot of misinformation out there and I want to make it a little easier for you to understand exactly how it's going to affect you. So if you are getting ready to sell your home, and you are trying to find an agent to help you list your home, get it sold, and get it to closing, you should do all of the same things that you would have ever done, right? You want to make sure that you're comfortable and that you're confident with the person that you're hiring and despite the fact that it is a seller's market, you want to make sure that, that agent is going to not only market your property but make sure it's not one of the 20% of deals that falls apart before it gets to closing. You want to get it to the finish line, right? So you want to make sure that you understand what your agent is going to do and how they're going to do it. Keep in mind that now, as has always been the case, you can negotiate the commission for the listing agent when you hire them. That doesn't mean that every agent is going to work for the price that you want, but you should make sure that whatever price you are paying, you are comfortable that you are getting a great value for that price. And great value does not always mean the cheapest. Great value can often mean I'm paying a little bit more, but I'm getting so much more. It is totally worth it. I saw an agent the other day say working with her was like ordering a 10-piece nugget and getting 11 and that's always my goal, to provide a level of service that goes beyond what you expect. But keep in mind that commission is always negotiable. You can choose whether or not you want to pay a buyer's agent, but if you call me to list your home, I'm going to explain the reasons why you probably do want to pay a buyer's agent. It's just gonna give you that many more buyers. Lots of buyers do not have the cash on hand to pay their agent and you don't want to dismiss them out of hand before they even get in the door of your house. If you have questions about listing your home, you have questions about what it's going to take to get it ready, or you have questions about the commission and how all that is going to break down and how those changes will affect you. Reach out to me give me a call send me an email, shoot me a DM, and let's talk about it and see what's right for you.

Read more