HomeBuying

Here you’ll find lots of information on buying a home, whether it’s your first, your tenth, to enjoy or invest in or anything in between. Markets, forms, and everything else are always changing in real estate, so check back here if buying is on your horizon.

So great, waving an inspection is a great way to get your contract at the top of the heap in a multiple-offer situation, but should YOU do it? I am going to tell you that if you don't have some sort of risk tolerance, don't do it. But if you do have a little bit of risk tolerance, there are ways to get around it. So you can pay an inspector a couple of hundred dollars to walk through the property with you and give you a general idea of how those systems, that you may not know how to assess, what kind of condition they're in. But at the end of the day, you are 100% going to have something happen, whether you have an inspection or not. I call these oh s**t moments, it might be six weeks, it might be six days, it might be a year. You can also buy a home warranty, the seller can buy a home warranty for you, or you can buy one yourself, but they're not going to cover everything. So you're still going to need a buffer. It is always a bit of a risk when you have a home that things might go wrong. So if you are on a razor-thin margin, a razor-thin budget, and you can only afford your mortgage payment, that may not be the house you want to buy anyway, inspection or not. But ultimately, your options are probably to pay way more than the asking price and ask for that inspection, giving the seller some sort of security, that they're going to have still a higher offer, even if they end up with items that they have to repair. Or you're gonna still probably pay more than you want in this market and waive the inspection. It's kind of up to you and where your risk tolerance is. But remember, at the end of the day, if everything is equal, that seller is always going to pick the offer that is the least risk for them. So the more risk you can take on the better price you are going to get on the house that you're purchasing. If you want to take a look at more ways to build an offer, write an offer, or buy a home in general, check out some of my other YouTube videos. Or better yet, give me a call. I'd love to talk to you and I'd love to help you find your dream home.

Read more

If you are under contract, and on your way to closing, you're super excited, you've started packing, and you started envisioning how you're going to design your space, here are a few things that you don't want to do if you actually want to close on your house and close on time. First of all, don't buy a car. Please, for the love of all that is holy, don't buy a car. If your car dies, and I have had clients for whom this happened, they have had to bite the bullet and buy a car in between contract and closing. But call the lender, let them know the situation, let them know what's happening, and ask them what to do before you go off half-cocked and do it. Because that can really impact your debt-to-income ratio and that can throw your loan way off track. Second, don't drag your feet on getting information to your lender. They do not want to ask you for a thousand documents and have to keep up with all of those things any more than you want to provide them. But they will not ask you for something they don't need. And as frustrating as it is. And as much as you want to yell at, you know, Marjorie that called you yesterday. And now she wants three more documents. It is not her. So don't yell at her. Just give them the documents they need because there is a process that they have to follow. And their systems going to tell them, oh, now we need this. And yes, sometimes that's the last minute. Third, don't quit your job, even if you get a fantastic job offer. Try to wait out the old job until closing and then take the new job. Yes, you can get a loan if you've been in the same career, same field for the last couple of years. So it may be fine, but it also may not. The best rule of thumb is to try to keep everything the same as it was when you made a loan application. And keep it that way until closing. If you have any more questions about the financial process or what it takes to get a loan and get into a home, I have some terrific lender partners that I'd love to put you in touch with and they would be happy to help you with that side of things. If you have general questions about buying or what it takes to go from contemplating a purchase to contract to close. Give me a call. I'd love to answer any questions you might have. And obviously, I'd love to help you get into the home that you want to be in.

Read more

The market that we're in and have been in for a while, moves fast likes fast and sometimes it is easy to get distracted with all the razzle-dazzle inside the house and not pay attention to the things outside of the four walls. So I've got a few things that I want to make sure that you're paying attention to, as you're looking at homes and trying to find that dream home that you actually want to buy. #1: Location. I know, it's really easy to get dazzled by all those interior features, but if the location is not where you want to be, then it's probably not going to be where you want to be. Because you don't stay in your house all the time. By location, I don't mean that if you really want to live in the city, you move to the suburbs, or vice versa. But if you generally want to be able to walk to coffee shops, maybe investigate other locations, that allow you to be able to do that, that allow you to get out walk with your dog, maybe it's a sidewalk neighborhood, maybe it's in town, but you don't probably want to change your entire lifestyle for where you want to live just because you love that actual house. So think about the location and know what your deal breakers are with that. #2: The next thing you want to make sure of is how much are you going to have to put into the house. So say it's a great location, it's the perfect place for you to be it's exactly the street you want you love everything about it and the house is pretty good. Can you live with the old out-of-date kitchen for a while? Or can you afford to go in and blast it out and redo the whole thing right away? So make sure you know what your tolerance is for the work, the financial expenses of the work, and the timeframe that the work is going to need to be get done. Because those things are going to matter when you actually get into the house and are living in it. You want to make sure that the trade-off for the neighborhood is equal to what you have to give up in making those changes and updates happen. #3: Is there an HOA? What does that include in Virginia? We do have a three-day right of rescission when you receive that package from the HOA. So if there is a homeowner's association, you do have to receive a copy of all the documents and you want to make sure that you look at them that you can live with what that is and look at the financials to make sure they're in a good financial position so that you're not going to have to pay an extra surprise $2,000 next year to redo the pool. And if you have to make sure that you love it enough that you want to spend that money and that you can afford it. #4: (and less important probably) The utility costs. I remember a time when I went from driving a Prius to driving a Toyota Highlander and let me tell you, I knew it was going to be a bigger car, but I was not anticipating that the gas would be like four times as much. So, I got over it but it was a little bit of a rude awakening and something I hadn't considered. So if you're going from a 1,500-square-foot house, and buying your 3,200-square-foot dream house, make sure that you can afford those utilities. This is particularly important when it comes to things like pools and hot tubs because that is a whole different set of heaters and water that you have perhaps never dealt with. And it's going to take a big hit on your budget for more information on all that goes into finding a home, purchasing a home, and things leading up to closing check out all of my buyer's videos on YouTube. There's a wealth of information there but if you have any questions that I can help with personally, or of course help you find a house in the Richmond area. I'd love to help give me a call.

Read more

Summer is here, and that normally means a dip in activity for the real estate market, but over the last few years, "normally" is a term that we've all sort of tossed out the window. (I'm sure you know what I mean.) If you're wondering where we are in the Metro Richmond market, here's a little snapshot of what's going on right now, as we dive into summer... As of the end of May, the average home's sales price was $455,408. For a little perspective, that's up from $428,999 in April of this year, and $435,893 in May of 2022. This despite the fact that interest rates are up by over a full percentage point year over year, and of course, lots of predictions that home values would tank. Those predictions didn't amount to much, since the tight market of the last few years has, in fact, just gotten tighter. Why? There are a few reasons- we are in a legitimate housing shortage, as many builders either stopped or slowed building any type of housing units after the bust of '07-'08, whole new buying pool has dropped into the market in the past few years, and with interest rates rising, there are loads of people sitting in their home with a 3% rate not even thinking about selling and having to buy at more than double that rate. Ugh. I know. Frustrating (to say the least) turn of events! That shortage of inventory means that while last year (2022) seemed like the craziest ever with homes selling on average at 107% of the asking price, we've only dropped down to 104% a year later, with much higher interest rates. The average days on market in the Metro Richmond market is only slightly higher than a year ago. In May '22, homes were on the market for 12 days, and now it's 17. But remember, that's the AVERAGE. The median is exactly the same, at 6 days. My thought, though, is that that is a muddy data point. Many homes lately are going on the market with delayed showings, often going on the market on Wednesday, with showings starting Thursday, and offers being reviewed on Monday or so (or some combination of similar days). In other words, "sold in one day!" is often not happening, as showings run for a set number of days, with a deadline for offers. What does all this mean for you? At the risk of repeating myself, if you're thinking of selling, it's still a great time. With so few homes on the market, your odds of selling very quickly are great. And while you'll definitely maximize what you get for your home if you do some work like staging, painting, and repairs, you'll likely still be able to sell easily even if you don't have the time or money to do those things. (So if you have a house you've been wanting to sell, but don't want to "put the work in" to get it done, NOW is a great time to put it on the market!) If you're looking to buy, this is a market where having a great buyer's agent can really put you ahead of the pack. There are lots of ways to "win" a home in a competitive situation without giving away all of your money and peace of mind, but it definitely takes planning and strategy right now. If you're thinking of buying or selling in this market (or anytime), I'd love to help you get where you want to be. Let's talk! *Information here is based on numbers from ShowingTime/Market Stats, and CVRMLS **Numbers are for the Metro Richmond area only

Read more

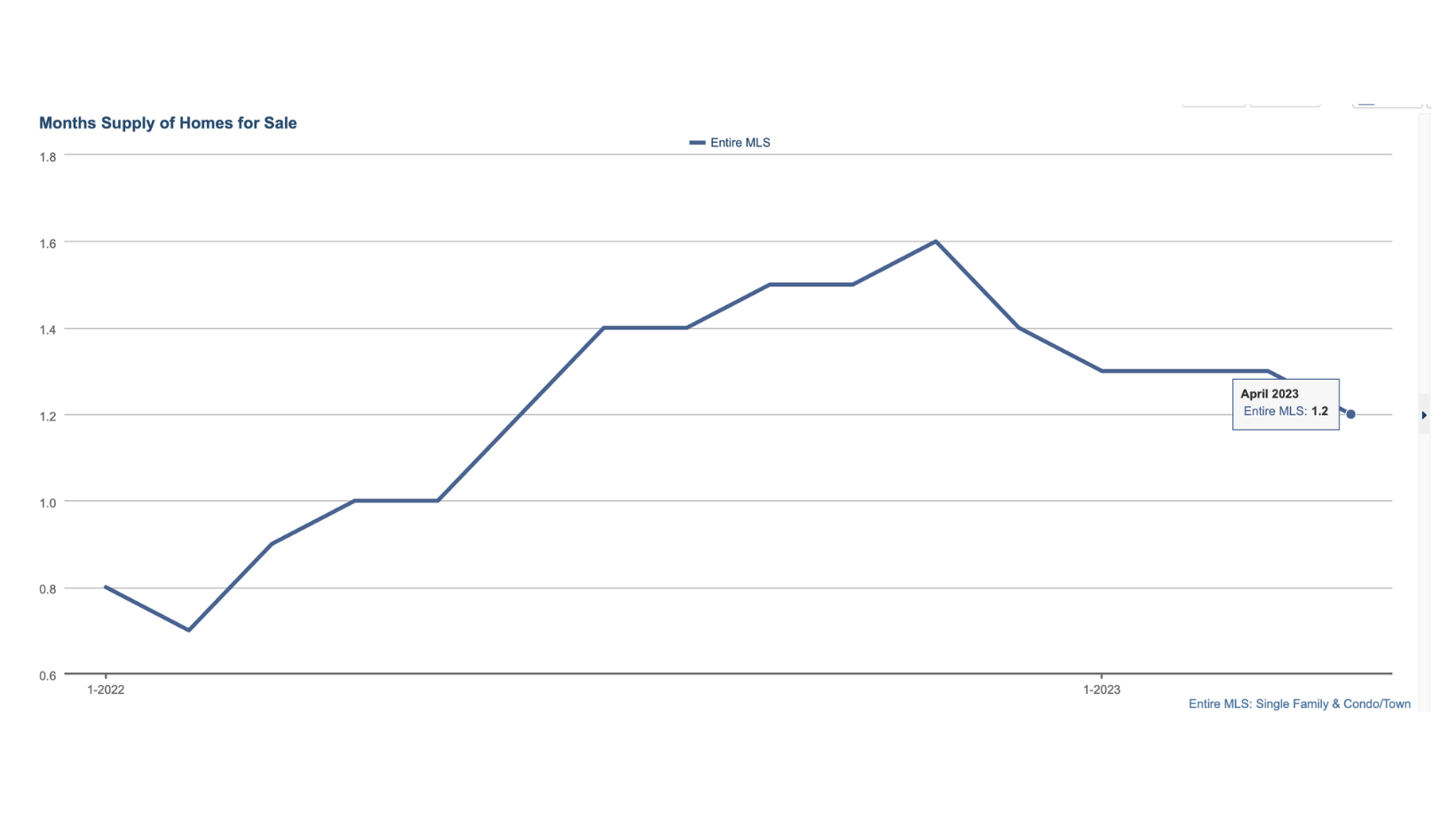

Well, spring is in full swing now, and April showers may have brought flowers, but they certainly didn't bring lots of real estate inventory. Things are still moving quickly, so here's a bit of a recap: The average sales price for our entire MLS area was $402,414 in April. That's up from $403,244 last April, and a good jump from March of this year at $386,797. The price stability and increases really are largely due to the lack of supply in the market. Rates have certainly risen since last year, but for the most part, it hasn't pushed many people out of the market. Our inventory as April closed out stood at 1933 homes for sale, down from 2203 in March, and down from 2022 in April of last year. Supply is just not where we need it to be (frankly, in either rentals or sales) and the demand is definitely out there. As I've said before, the market is considered to be balanced at 6 months supply of inventory, and while we're definitely better than we have been (February '22 had us as low as .7 month), we are still only at 1.2 months. That means that if no other homes came on the market, it would take 1.2 months for the supply to be exhausted. That's not much. What does this all mean for you if you're looking to sell? What about buying? Is it just a crazy time to do that?? These questions are both so unique to your own situation, I always hesitate saying, "it's a great/bad time to sell/buy," to a degree, regardless of the market. What I can say, though, is that if you've been contemplating selling and you thought the market was going to drop as rates went up, that hasn't proven to be true. In most areas, we are still very decidedly in a seller's market, so no doubt that it's a good time to sell. If you're thinking of buying, and it's a great time for you otherwise- new job, lease is up, new baby, new job...whatever, it's not a terrible time to buy- prices do not have the same upward pressure that they had a year ago. Yes, we're seeing multiple offer scenarios, but not every house, not every time, and often not as insane as the offers were last spring. We are seeing more inspections, more appraisals, and a bit more negotiations on some homes. But, it's not the time to drag your feet if you're looking. It's a good time to really know what your negotiables and must haves are, and work with an agent with a solid grasp on the market (like me) that will tell you what they think will get the home you want, rather than just guessing. Keep in mind, too, that there is no perfect market. If rates are lower, prices will be higher, and vice versa. It's nearly impossible to time the market, too. So if it's a good time FOR YOU, it's probably a good time. If you have questions about buying or selling in this market, reach out. I'd love to talk to you and help you determine if it's a great time for YOU.

Read more

It is a good time to buy? Is it a good time to sell? What's the market doing? These are just a few of the questions I always get asked as a realtor. Didn't answer your questions? Let's talk! DM me on Instagram @cindybennettrealestate or via my website at cindybennett.net.

Read more

You're getting ready to buy your first house, but everyone you know who bought a house in the last couple of years didn't have an inspection. But guess what? You can! Let's talk about home inspections. If you have questions, reach out to me, I'd love to help. DM me on Instagram @cindybennettrealestate or via my website at cindybennett.net

Read more

You've been thinking about buying a house for the last few years - perhaps waiting for the market to crash. Our market is definitely shifting. Is it better to buy houses priced on the high end and interest rates low OR flip that - interest rates high and housing prices coming down? Let's talk about it. Can I answer your real estate questions? Reach out, I'd love to talk. You can find me on instagram @cindybennettrealestate.

Read more

Are you thinking about buying a home in the Spring and wondering what you can do now to get started? I've got 5 things you can & should do now so you're ready to buy a home this coming Spring. Still have questions? I'd love to set up a time to talk and get you on the way to buying a home. Reach out to me on Instagram @cindybennettrealestate

Read more

In my latest Real Talk with Cindy, I sit down with Josh Crowley at Liberty Mortgage. We discuss mortgage options in today's changing market, pre-approvals, seller concessions, and first-time buyer tips. It's a conversation you don't want to miss. Have more questions? We'd love to help. Reach out to me on Instagram @cindybenettrealestate or via my website at cindybennett.net or Josh at Liberty Mortgage at 757-784-7269.

Read more