Blog

Welcome and thanks for stopping by! My blog is filled with market updates and real estate info, but also Richmond area spots and favorites, fun stories and lots of recipes that I love (please try them!).

I love to share, and never gatekeep, so please bookmark my blog, check back often, and of course, don’t forget to subscribe to my newsletter!

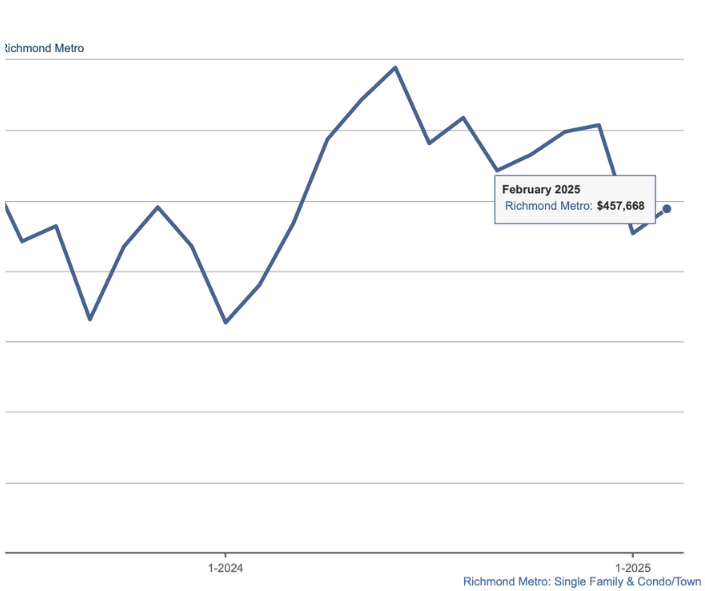

Market updates are a bit like tapping the mic with an "is this thing on?" People say they want them, but I always wonder how much they actually get read. So if you're reading this, please let me know! March 20 heralds the first day of Spring, and I for one couldn't be more excited. But if we're talking about the market, it really has felt like spring for a while now! Here's a little bit of data to give you a snapshot of the overall market in the Richmond Metro. The average sales price in the Richmond Metro in February was $476,907. That's a bit lower than the prices in December, but a bounce back from a lower January price of $469,296, and it looks like it's back on the upward trend. If you've followed me for a little bit, you've probably heard me talk about the months supply, and how at a balanced market, we'd have about 6 months of inventory. It's been a while since we've been there, and for the last 2 months, we're holding strong at 1.3 months of inventory. A good distance from balance. This data tracks in what I've seen in the last couple of weeks, as well. Lower inventory means you may need to compete to get that home you love, because there are simply more buyers than there are great houses. Sometimes that means you have to pay more, but sometimes it just means having as much info as you need to craft an offer that will be the most appealing to the seller. Every situation is a little different, so there really is no one size all formula here. If you're selling, lower inventory means you have more eyeballs on your house, usually more showings, and (in many cases) more offers. Yes. You only need one offer, but the nice thing about multiple offers for you as a seller is that when people are competing, you're less likely to have to deal with a lot of inspection issues, you usually get more money, and you are more in the driver's seat with the entire transaction. We're seeing lots of multiple offer situations, although the market is quite price sensitive. What does that mean? You can't just thrown any home on the market, at any price, and think it's going to sell. The homes that are not "market ready" are still sitting on the market, and generally not getting multiple offers. Having your home ready makes a huge difference, as does pricing it well. Price it too high, and it just might sit there as well. There are definitely neighborhoods and areas that are more popular, and others where things are not quite as "wild." Knowing which one you're in, or looking in, can make a huge difference. I'd love to talk to you about the area you're in (or want to be in) and help you determine the best strategy to get you where you want to be. What are your market questions? Reach out!

Read more

Unlock the secret to choosing the right realtor with what I believe is the "game-changing" opening question for every interview. Ready to get started or just curious? Send me a message here on my website or send me an email at [email protected].

Read more

It's March, and that means St. Patrick's Day is almost here! In my family, that doesn't mean beer as much as it always, always, always, means plentiful corned beef and cabbage. (In fact, whenever my mom finds a good deal on corned beef- usually this time of year- she'll buy 3 or 4 and freeze them for later) If you love it as much as we do (impossible!), here's a great recipe using the Instant Pot so you can set it, forget it, and don't spend all day in the kitchen. Ingredients 1 3-pound corned beef brisket, plus pickling spice packet or 1 1/2 tablespoons pickling spice 1 medium onion, sliced 3 cloves garlic, chopped 1 (14.9 oz) Guinness beer 1 cup beef broth 1 pound new potatoes 3 large carrots, cut into 3-inch pieces 1 head Savoy cabbage, cut into 2-inch wedges Kosher salt and freshly ground pepper, to taste 2 tablespoons whole grain mustard Directions Rinse brisket with cold water and thoroughly pat dry. Place onion, garlic and pickling spice into a 6 qt Instant Pot. Gently place brisket on top of the onion mixture. Top with beer and beef broth. Select manual setting; adjust pressure to high, and set time for 85 minutes. When finished cooking, quick-release pressure according to manufacturer’s directions. Remove brisket from the Instant Pot; wrap in foil and keep in a warm oven. Remove and discard onion mixture, reserving 1 1/2 cups cooking liquid in the Instant Pot. Stir in potatoes and carrots; top with cabbage. Season with salt and pepper, to taste. Select manual setting; adjust pressure to high, and set time for 4 minutes. When finished cooking, quick-release pressure according to manufacturer’s directions. Thinly slice corned beef against the grain and serve with potatoes, carrots and cabbage Serve mustard on the side, if desired. Try to save a bit for some hash or a sandwich the next day!

Read more

Click each event below for more information, for a full calendar of events click HERE. Do Portugal Circus Pours & Pasties Burlesque and Variety Show St. Patrick's Day Charcuterie Workshop RVA Brick Day 2025 Virginia Derby Shamrock the Block The Irish Festival Pretend Again: A Grown-Up Night at the Museum Richmond SPCA Dog Jog, 5k, and Block Party The Wizard of Oz on Ice

Read more

For a printable checklist, click HERE.

Read more

If these (hopefully) final days of winter and snow are keeping you more stuck inside, there are lots of things you can do get your house ready to sell if that's on the horizon for you! I'm including my checklist here, but a couple of other tips I have- Set a timer for each room. Do as much as you can in that time period with no distractions. (Reset if you need to, but setting a time limit really helps me focus better and that task doesn't yawn endlessly before me!) Do a "blue tape walkthrough" for your house- just like we do with new construction to note areas for the contractor to come back to. Better yet, have me (or a good friend with an eagle eye) do it. This will help you get your list together of projects to do before selling- things like that jiggly towel bar, the outlet that doesn't work, the paint and caulking touch ups... then call me for my vendor list, or reach out to the folks you've worked with before who can help you! Check out the downloadable checklist below and see what you can accomplish! Click HERE or the image above to download.

Read more

Although it's nonstop snowing as I type this, the spring market has already begun. Yes, rates are still not great, and there is still not a ton of inventory, but in any type of market, people are going to want to, and more than that, need to, move, and it looks like the times of fence sitting to see how rates are is really about over. So if you're buying or selling, here's some great info to know, as we are finishing up (I hope!) winter, and kicking off spring! Prices in the Metro Richmond area have dropped since the beginning of the year, a good bit, in fact. In December, our average sales price was $411,635, and for January, that average sales priced dropped to $394,900. New listings have spiked from December's 793, up to 1171 for January. By my calculations, as I assess February up until today (2/19) we have approximately 893 new to market listings for the month already, and we've got about 10 days to go. This is all good news for buyers getting into the market. More inventory means lower prices, and less competition, which is definitely welcome, when rates are where they are. Just as good news- while we are still seeing some competitive situations, there are generally fewer than there have been (think 4-10, rather than 20-40, in most cases) and we are once again seeing not only inspections, but it some cases, we're even some seller concessions at closing! What if you're selling? No bad news there either. As I mentioned before, we are still seeing multiple offers in many cases. The median list to sale price ratio in January was still at 100%. The average was still a bit over that. Is that a guarantee? Of course not. What I can tell you is that the more you do to get your home ready to sell (fixing/repairing), cleaning, decluttering, landscaping, etc., the better off you will be when it comes to list. When it comes to pricing, and those little things that make your home stand out from the rest, they can make a huge difference in the speed of sale, and the number and quality of those offers. If you've got questions about selling your home or thinking of starting a home search, I'd love to talk to you!

Read more

Click each event below for more information, for a full calendar of events click HERE. The Diary of Anne Frank Dirty Dancing in Concert Galentine's Day Market GardenInk Cinderella: Presented by the Richmond Ballet 24th Annual Pet Expo

Read more

*Easier* Chocolate Mousse 3 1/2 ounces dark chocolate (62% cacao is ideal) 1 tablespoon unsalted butter 2 large egg yolks 1 tablespoon white sugar 1/4 cup water 1 tiny pinch salt 1/2 cup chilled heavy whipping cream Directions Break up chocolate and set aside with butter. Add egg yolks, sugar, water, and salt to a metal mixing bowl. Cook, whisking, directly over medium-low heat until the mixture is thick, foamy, and hot to the touch (145 to 150 degrees F (63 to 65 degrees C)). (Yes, you put the bowl on the heat. You can use a saucepan, but it's so much easier to whisk in a bowl!) Once the yolk mixture is thick and hot, add chocolate and butter, and whisk until all the chocolate is melted. Let rest for a few minutes on the counter, whisking occasionally to further cool the mixture to just above or at room temperature. The chocolate mixture shouldn’t go into the whipped cream while still warm, but if cooled too long, the mixture may get too firm to fold in. Whisk cold cream until medium stiff peaks form. If cream is beaten too much, it will separate and the final texture will be grainy. Transfer about 1/3 of chocolate mixture into whipped cream, and fold with a spatula until almost incorporated. Gently fold in remaining chocolate, trying to keep as much air in the mixture as possible. Transfer into 4 serving dishes, wrap, and chill before serving, at least 1 hour. Serve with more whipped cream, shaved chocolate, berries, or whatever your heart desires!

Read more

Click each event below for more information, for a full calendar of events click HERE. Dancing with the Stars: LIVE! Sensory Friendly Night Downtown Candlelight: A Tribute to Adele Edgar’s Sweet 216 Birthday Bash Celebrate MLK with the Richmond Symphony 999: The Forgotten Girls (Holocaust Remembrance Day) Special Bourbon Dinner Event Soul Aerial and the Performing Arts Center Present: Alice in Wonderland Hanover Tavern ParaCon

Read more