Blog

Welcome and thanks for stopping by! My blog is filled with market updates and real estate info, but also Richmond area spots and favorites, fun stories and lots of recipes that I love (please try them!).

I love to share, and never gatekeep, so please bookmark my blog, check back often, and of course, don’t forget to subscribe to my newsletter!

I started cooking when I was 11 or 12, and never really stopped. When I was 22 (yes, 22) I bought a cafe/catering business in Carytown, inheriting lots of great recipes and adding many more. That's been many years ago, but I do have most of those recipes still, and I did a second "release" of my cookbook last Christmas. In it, there are many of those recipes from Gourmet Delights, including this chicken salad. It was a huge hit then and is still a hit now. (We had one customer who would nearly buy it out once a month and loads of people for whom it was seriously a mainstay in their diets. My brother took this shot with the chicken salad and the cookbook (obviously he took some liberties with the recipe) and I thought this one would be a great one to share as we get into the warmer months. Gourmet Delights Chicken Salad Servings: 4 Prep Time: 30 minutes 2 whole chicken breast halves, poached, cooled, and chopped coarsely 1/3 cup mayonnaise 1/3 cup sour cream 3 teaspoons lemon juice 1 teaspoon Jane's Crazy Mixed Up Salt dash of cayenne pepper 1 whole minced green onion 1/3 cup chopped celery Whisk together all ingredients except the chicken, green onion, and celery. Stir sauce, chicken, green onion, and celery together and chill until ready to serve. Modifications: Preparation: I love this with medium-sized cubes of chicken, but cut or shred the chicken to your liking. Additions: Halved grapes and crushed pecans Dried cranberries and slivered almonds Blueberries and blanched almonds Add fresh herbs- 2 TBS parsley and 1 TBS chopped tarragon add great flavor and freshness Get creative! Serving: Obviously makes a great sandwich, but terrific on a bed of lettuce, or old school in a hollowed out tomato. We also served this frequently as a melt, on a toasted croissant with a slice of melted cheddar. That was a big hit too! Enjoy!

Read more

Most seasons, I like to do a "Must Do" list of things that I want to make sure I do before the time slips by. Sometimes they're simple, and sometimes more elaborate, but I love them because they make me think about the things that I particularly love or look forward to about that season, and sometimes just the reminder makes me happy. Always, it pushes me to do a bit more than the everyday mundane that we often get stuck in. So, without further ado, here's my Spring/Early Summer list of things I am looking forward to doing in and around RVA! (In no particular order) 1 Friday Cheers kicks off this week- Nothing says Summer in RVA quite like it! 2 Have a picnic at Maymont- With your love, family, friends, or a great book 3 Visit the Sno Shack in Mechanicsville for a Tiger's Blood shave ice 4 Patio dinners! My faves- Can Can, The Daily, or East Coast Provisions 5 First Fridays in the Arts District 6 Head to Sneed's Nursery and pick up some native plants (and plant them!) 7 Take a drive to Topping for lunch on the water at Merroir. 8 GrowRVA South of the James Market at Forest Hill Park for produce (and treats) 9 Strawberry season at Agriberry Farms means Strawberry Shortcake! 10 Get out on the James on a warm day 11 Learn something new about Richmond 12 Fire up the grill and enjoy the patio at home Do you have a list like this? What is a must do you have for this spring?

Read more

Almost Classic, Customizable, Vinaigrette 1 cup oil (I usually use olive or avocado oil) 1/2 cup vinegar (your choice- red wine, apple cider, champagne, balsamic...) 1 tbs Dijon mustard 1 clove of garlic, finely minced or grated 1 tsp salt Fresh cracked black pepper to taste Put all ingredients in a container or jar and shake vigorously. (I have 2 Mason jars that I use and there is nearly always one on hand in the fridge.) I make a variation of this for every salad, with modifications. I don't add sugar, because I don't think it's necessary. (I always used to, then one day tried it without and didn't miss it at all.) Here are a few ideas to get you started... For Greek and Italian inspired flavors, add juice of a 1/2 lemon, 1 tbs of chopped fresh oregano or a tsp of dried For salads with fruit, add 2 tsp honey, apple cider vinegar, 1 tbs of chopped fresh mint (You can also use a bit of fresh squeezed orange juice, or add a few berries and blend in a blender for a real fruity punch.) For Mexican inspired salads, add the juice of a lime, 1 tbs of chopped cilantro (If you're feeling adventurous, you can add 1/4 tsp of cumin or chili powder- or both) There are a million ways to go with this, and as you get more comfortable with the ratios and the flavors, I bet you'll use it as much as I do. It's healthier, and much, much cheaper than those grocery store dressings.

Read more

Something about spring just inspires projects, for me at least. Whether you're selling or you just want to enjoy your home more, there are loads of low-cost home improvement projects that can provide a high return on investment. Here are my top 10 ways to add value to your home with a low investment and high return in Spring 2023. Add a Fresh Coat of Paint One of the easiest and most affordable ways to add value to your home is by painting the interior and/or exterior. A fresh coat of paint can instantly make your home look newer and more appealing to potential buyers. Upgrade Your Lighting Installing new light fixtures can make a big impact on the look and feel of your home. Consider replacing outdated fixtures with modern and energy-efficient options that can brighten up your space. Improve Your Landscaping A well-maintained lawn and garden can significantly improve your home's curb appeal. Consider adding some colorful flowers, planting new trees or shrubs, and trimming any overgrown bushes. Update Your Kitchen Hardware Upgrading your kitchen hardware, such as cabinet knobs and drawer pulls, can make your kitchen look newer and more modern. This is an affordable way to add value to your home without having to do a complete kitchen renovation. Add Some Outdoor Lighting Outdoor lighting can enhance the appearance of your home's exterior while also providing safety and security. Consider installing solar-powered pathway lights, string lights, or floodlights to illuminate your outdoor living spaces. Replace Your Front Door Replacing your front door with a new, energy-efficient one can make a big impact on your home's curb appeal. Choose a door that complements the style of your home and adds a pop of color to make it stand out. Add a Backsplash to Your Kitchen A stylish backsplash can transform the look of your kitchen without breaking the bank. Consider installing a tile or mosaic backsplash to add color and texture to your space. Upgrade Your Bathroom Fixtures Replacing old bathroom fixtures, such as faucets, showerheads, and towel racks, can give your bathroom a modern and updated look. This is an easy and affordable way to add value to your home. Clean and Organize Your Garage A clean and organized garage can make a big impact on potential buyers. Consider adding shelves or storage bins to keep your garage tidy and clutter-free. Replace Your Window Treatments Upgrading your window treatments can add a touch of style to your home while also improving energy efficiency. Consider replacing old curtains with blinds or shades that are both functional and stylish. By making small upgrades such as painting, upgrading lighting fixtures, and improving landscaping, you can make your home more attractive to potential buyers (or yourself!) without having to spend a lot of money.

Read more

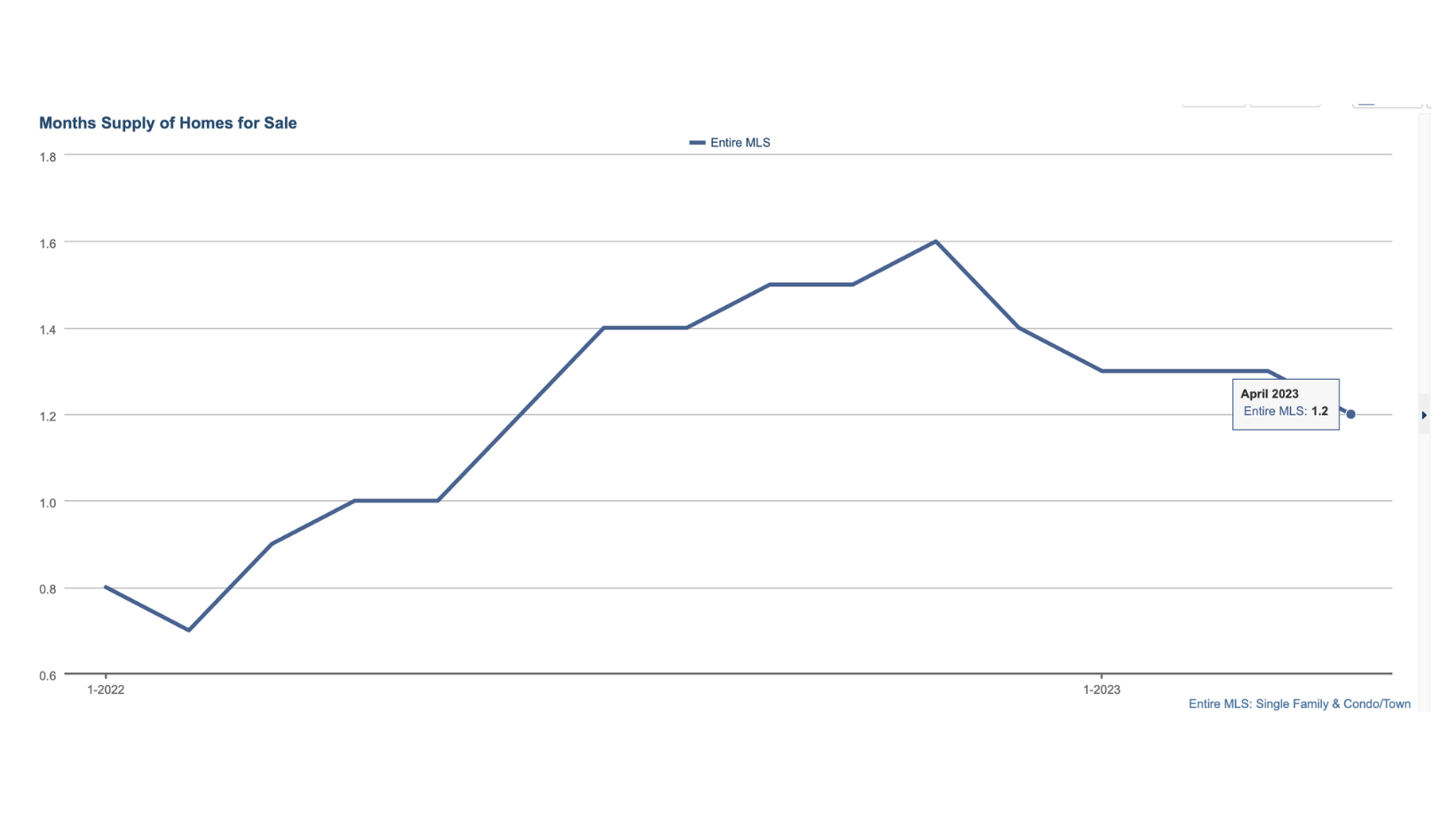

Well, spring is in full swing now, and April showers may have brought flowers, but they certainly didn't bring lots of real estate inventory. Things are still moving quickly, so here's a bit of a recap: The average sales price for our entire MLS area was $402,414 in April. That's up from $403,244 last April, and a good jump from March of this year at $386,797. The price stability and increases really are largely due to the lack of supply in the market. Rates have certainly risen since last year, but for the most part, it hasn't pushed many people out of the market. Our inventory as April closed out stood at 1933 homes for sale, down from 2203 in March, and down from 2022 in April of last year. Supply is just not where we need it to be (frankly, in either rentals or sales) and the demand is definitely out there. As I've said before, the market is considered to be balanced at 6 months supply of inventory, and while we're definitely better than we have been (February '22 had us as low as .7 month), we are still only at 1.2 months. That means that if no other homes came on the market, it would take 1.2 months for the supply to be exhausted. That's not much. What does this all mean for you if you're looking to sell? What about buying? Is it just a crazy time to do that?? These questions are both so unique to your own situation, I always hesitate saying, "it's a great/bad time to sell/buy," to a degree, regardless of the market. What I can say, though, is that if you've been contemplating selling and you thought the market was going to drop as rates went up, that hasn't proven to be true. In most areas, we are still very decidedly in a seller's market, so no doubt that it's a good time to sell. If you're thinking of buying, and it's a great time for you otherwise- new job, lease is up, new baby, new job...whatever, it's not a terrible time to buy- prices do not have the same upward pressure that they had a year ago. Yes, we're seeing multiple offer scenarios, but not every house, not every time, and often not as insane as the offers were last spring. We are seeing more inspections, more appraisals, and a bit more negotiations on some homes. But, it's not the time to drag your feet if you're looking. It's a good time to really know what your negotiables and must haves are, and work with an agent with a solid grasp on the market (like me) that will tell you what they think will get the home you want, rather than just guessing. Keep in mind, too, that there is no perfect market. If rates are lower, prices will be higher, and vice versa. It's nearly impossible to time the market, too. So if it's a good time FOR YOU, it's probably a good time. If you have questions about buying or selling in this market, reach out. I'd love to talk to you and help you determine if it's a great time for YOU.

Read more

So I have lots of clients, especially millennial clients, who frankly could live in a one-bedroom apartment for the rest of their lives and be totally fine with it. But the one thing that they're going to buy a house for... their dog. We are actually seeing more and more people buy homes for their dogs or their pets. So, if you're one of those people that is thinking, I want to buy a house, but it really has to be a good fit for my dog, here are some of the things that you want to think about. First of all, you want to make sure it has a yard, probably a fence. Fences are not cheap. So if you find a house that has already got a fence, that's definitely a win. Is it a walkable neighborhood? Is it somewhere that you're going to go out and take your little guy for a stroll in the evenings or before work? Do you feel comfortable doing that? Are there sidewalks? Is there a good shoulder that's going to give you a lot of space? Richmond is such a dog-friendly city. We've got lots of cool dog parks and cool places to go. You can bring your pet from breweries to dog parks and that's just a great way for you and your pet to meet new people and dogs. So if you're one of those people that is looking and really wants to be dog-centric in what you're looking for to call home, I'd love to help you. Maxwell can weigh in. He won't necessarily be at every show but he will give his opinion.

Read more

12 ounces spaghetti, linguine or bucatini 1 shallot, thinly sliced 2 garlic cloves, thinly sliced Zest and juice of 1 lemon, plus more lemon zest for serving 3 sprigs basil, plus more for serving 1 teaspoon kosher salt ¾ teaspoon freshly ground black pepper, plus more for serving 1 cup fresh or frozen peas (thawed if frozen) 1-2 Tbs butter 1 cup grated Parmesan cheese 1. Combine the pasta, 4½ cups water, shallot, garlic, lemon zest, basil, salt and pepper in a large skillet with 2-inch sides. 2. Bring the water to a boil, then turn down by 1/3 and cook, stirring occasionally, until the water is nearly gone and the pasta is fully cooked, 8 to 10 minutes. (Pay attention here!) As water is almost evaporated, add peas and butter. 3. Stir until butter is combined and melted, then add the lemon juice and Parmesan, and toss to combine. Season with salt and pepper to taste. Garnish with basil leaves and lemon zest. This pasta is flexible, too! I had no basil, so I used parsley here. Still delicious! Also great topped with grilled chicken breast, salmon, or grilled shrimp.

Read more

Richmond is pretty great in most seasons, but festival season? That's really where we shine! There's little the River City loves more than the combo of outdoors+live music+friends+food trucks+celebration, and of course, adult beverages. Here are a few of my favorites, kicking off in March! March 5-12- Richmond Black Restaurant Experience. Less of a festival, and more of a weeklong celebration of our black owned restaurants. I'm a foodie, so this one definitely counts! March 11- Shamrock the Block moves to Leigh Street this year! Shamrock The Block is a FREE street festival in its 17th year and the kickoff to festival season! March 25-26- Church Hill Irish Festival. This one has the best to offer the 21+ crowd as well as the younger set. It's a party for everyone, and a great way to get a taste of Ireland in RVA. March 30-April 2- French Film Festival. Widely recognized as the best French Film Festival in the country, this event is held at the Byrd Theatre in Carytown, and is in its 29th year this year. A great way to pick up a little culture for a weekend. April 22- Ukrop's Monument Avenue 10k. Touted as "Richmond's Biggest Block Party," that's a pretty accurate assessment. You can run. You can walk. You can do a bit of both. or you can just come down to cheer and party. Whatever you do, it's F U N for all ages. April 29- Herbs Galore & More at Maymont. Great plants- far beyond herbs, live music, food trucks, and more! This is a great way to learn while enjoying a day out, AND getting some great new plants for home. May 6-7- Arts in the Park. Surely one of the best things Richmond is known for is our passion for the arts, and all of the wonderful artists that call RVA home. Arts in the Park is a wonderful celebration of this. This free event is one of the largest outdoor events in Richmond, and a nationally rated juried arts and craft show. Also, just one of the best ways to get out and celebrate spring at Byrd Park. May 19-21- Dominion RiverRock- So much to do and see at this one, and it combines all our loves- the James River, getting outdoors, art, food, drink, and music! Seriously fun for the whole family, and always something new to see! June 1-4- Richmond Greek Festival- Celebrate Greek culture with music, dancing, vendors, and absolutely delicious food! (Fun fact- when my son was a baby, he wouldn't touch green beans until he had the ones from the Greek Festival, so I got the recipe and made them all through the toddler years!) Grab some friends, a couple of bottles of greek wine, and spend the day. It's a true Richmond tradition! July 14-15- Hanover Tomato Festival - Even those of us who don't live in Hanover claim the almighty Hanover tomato, and for good reason. They really are the absolute best. (I even know someone who moved far away but took a truckload of Hanover soil and plants to try to take them with her!) This is a celebration of the tomato, with lots of fun for the whole family (pet friendly, too!) July 29- Beer, Bourbon, and BBQ Festival- The 14th annual, and need I say more? There's music, tastings of all your favorite "B's" and lots of vendors, too. At the Meadow Event Park in Doswell. August 12- Jam Packed Craft Beer and Music Festival- Just what it sounds like. This festival starts at 3:30 on Saturday, and August 13- Carytown Watermelon Festival- Food, music, vendors, fun, and of course, watermelon! (I mean, SO MUCH WATERMELON!) Super family friendly, lots of fun, and free! Obviously this list is not exhaustive, and there are PLENTY of other smaller events on Brown's Island and around town to learn more about RVA, our rich culture, and try great food and drink, enjoy music, and just have FUN. Where will you be going??

Read moreIt's hard to watch or listen to the news on any platform lately without getting some sort of news on the housing market. To hear the national news, things have cooled tremendously, but we all know that real estate is really local, right? The story around here is, more or less, a simple tale of supply and demand. A six month supply of housing units is widely considered to be a balanced market (neither buyer nor seller’s market), and we are still in a market with only just over 1 month’s supply. That means the simple concept of supply and demand is going to keep prices steady for a while, and in many pockets of our market, keep things competitive. (For perspective, in February of 2022, the inventory low- we had only .7 months.) For the same sort of perspective, in February or 2022, we only had 1544 active listings in our MLS, and this February, we closed out with 1792. That’s just not that big of a jump, and the buyers are still out there. In fact, homes last year this time were selling on average for close to 107% of listing price, but this year, they are still selling at nearly 98%. (And that’s an average. The median list price to closing price percentage is sitting at 100%) Last January, the average sales price of a home in the area was $378,029. This January, that price is up to $388,060. Yes, that’s up, for sure, but it’s important to note that the average price in May 2022 was $435,893. Does that mean the market has dropped/cooled/changed? Well, sort of. Things have definitely been flattening out from the wild spikes of the last couple of years, and if you were hoping to get on the market and garner 20 cash offers with huge escalations and no inspections, you may well have missed that boat. However, despite what you hear on the national news, our market is in a much softer correcting cycle than many in the country. Anecdotally, we have seen more and more buyers be able to have home inspections, appraisals, etc, over the last few months. That's been a very welcome change for the buyers out there, and we are still seeing them, but perhaps to a lesser degree at the moment. As we head into spring, and the spring market, we're definitely seeing more of those multiple offers, and more situations where those things are being waived again. In short, while rates have definitely gone up, there are still lots of buyers out there looking for homes, and just not enough homes out there for them. While we do anticipate that inventory loosening up a bit as the weather warms, we definitely need more listings! If you're thinking of selling, it's definitely a great time. And if you're thinking of buying, we can get you where you want to be! What will it take? Just a little bit of planning, a little creative/out of the box thinking, and yes- patience. If you have questions about the market, or just your little section of it, reach out! I'd love to break down the data that matters for YOU. *Graph and data- MarketStats by ShowingTime

Read more

It is a good time to buy? Is it a good time to sell? What's the market doing? These are just a few of the questions I always get asked as a realtor. Didn't answer your questions? Let's talk! DM me on Instagram @cindybennettrealestate or via my website at cindybennett.net.

Read more